Explore cutting-edge strategies like utilizing AI for informed decision-making, incorporating ESG criteria for sustainable returns, leveraging big data for market insights, and employing modern technologies to enhance portfolio management and performance.

Using Technology in Investment Management

The Impact of Technology on Investment Management

Investment management has seen a sea of change to greater effectiveness, efficiency, precision, and accessibility owing to technology innovations. This change is elicited by robo-advisors that are algorithm-driven revelation-based systems, automated trading systems, and advanced analytics and visualizations, and blockchain technology.

Role of Robo-Advisors

Primarily, robo-advisors do not need human guidance or intervention in the management of the financial position of others. Specifically, as of 2023, the global AUM by robo-advisors is around $460 billion, and these are forecasted to continue increasing due to ongoing gains from technology and perceived acceptability. Notably, algorithms used mimic human investment advisors to match customers’ risk tolerance and financial goals.

Impact on Trading and Market Liquidity

Its deployment in the market has lessened the high-frequency trading spreads to improve market liquidity and cost of trading for all traders. Moreover, it reveals the role it plays in portfolio and pricing between currency portfolios and its cryptos.

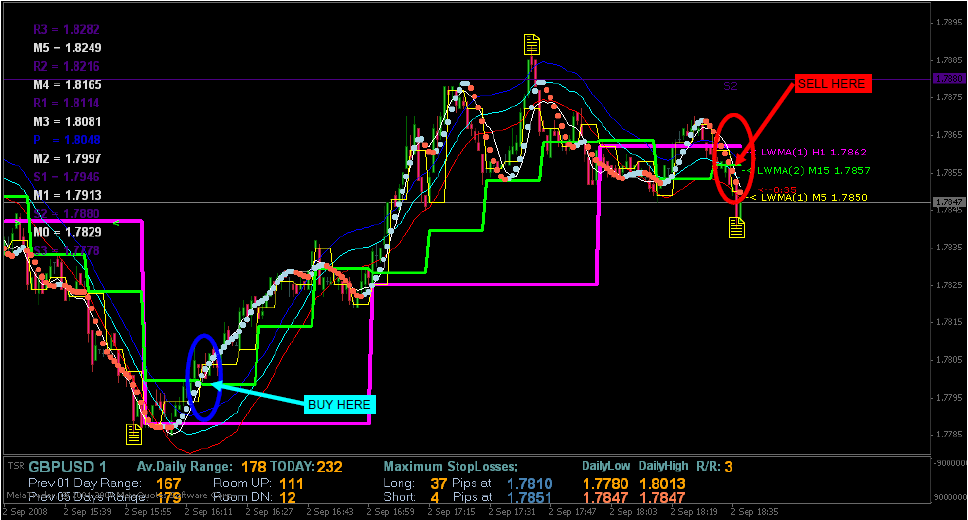

Advancements in Analytics and Visualization

The introduction of advanced analytics gives financial experts and managers clear understanding and insight into market trends, desirable factors correlated with doming or declining good and bads, and KPIs. Visualization tools convert available facts into understanding actionable facts across different graphs and decisions that enable a manager to make decisions based on facts quickly.

Predictive Analytics in Investment Decision Making

Basically, predictive analytics helps the investor determine threats across his or her portfolio before deciding to trade on trends.

Integrating AI for Better Portfolio Decisions

AI in Enhancing Portfolio Decision Making

Integration of Artificial Intelligence in portfolio management changes the landscape of investment decision-making, enables provisioning of precise and real-time insights, and automates difficult decision-making processes. AI technologies are capable of processing immense amounts of data for identifying investment opportunities, managing risks, and optimizing asset allocation, improving portfolio performance and minimizing human errors at the same time.

AI-Driven Predictive Models in Market Analysis

For example, AI-driven machine learning models leverage historical and real-time data for predicting market trends and asset price movements with high precision. In 2023, AI models predicted the upcoming market bear almost 70% of the time, whereas traditional models failed. Machine learning models use economic indicators, corporate earnings reports, and geopolitical events to dynamically adjust portfolio allocations in order to maximize predicted future performance.

Natural Language Processing in Sentiment Analysis

Natural Language Processing tools scan through thousands of news articles, financial reports, and social media posts to estimate market sentiment. This measure reflects prognosis regarding market movements that are based on human emotions linked with information received. Sudden negative sentiment surge regarding the target industry may indicate future sell-offs; therefore, AI systems sell to rebalance the portfolios in advance.

AI’s Role in Risk Detection and Management

AI proves to be strong in detecting and evaluating risk due to the ability to identify patterns and anomalies unnoticeable for human analysts. If the market seems uncertain the next day, AI uses predictive analytics and suggests that certain assets be sold and reallocated to assets labeled as safe. It is an extremely inform decision action type since it is based on ensuring portfolio maintenance and securing long-term investment objectives.

AI in Compliance and Reporting

AI automates compliance by verifying that all transactions conducted with the portfolio are legal, and notify the stakeholder immediately when they are not. AI also generates detailed reporting for ensuring compliance.

Sustainable and Responsible Investing

Sustainable and responsible investing is a rapidly evolving trend driven by investor demand for social good, not just financial returns. This concept revolves around including environmental, social, and governance criteria into investments to promote long-term obedience to ethical practices.

ESG Criteria Integration

This includes reviewing the companies’ ecological footprint, responsibility in the social dimension, and governance. According to the most recent information available from 2023, sustainable investment strategies manage over $35 trillion of assets globally. This is why, when considering investment opportunities, more and more investors screen companies based on their ESG scores. For example, they must use a sufficient amount of renewable energy, and their workers have to abide by fair labor market practices.

Impact Investing

This refers to the funds directed into projects or companies producing social or environmentally friendly outcomes with financial returns. This can include investment in companies producing renewable energy, affordable residential, or medical services in underserved communities. The outcomes can be measured using metrics such as carbon emission reduction or an increase in employment rates.

Shareholder Activism

Shareholder activism allows investors to use the power of ownership to enforce the responsible behavior of the company. This can be done through direct negotiations, in some cases, or proxy voting during the general meetings. Some investors may advocate for leaner environmentalism or labor conditions. This has the twofold effect of enforcing the responsible behavior of the companies where individuals have invested while protecting their own interests.

Sustainable Fund and ETF Options

Sustainable mutual funds and ETFs have been granted the go-ahead. In this manner, the most effortless and flexible way to invest responsibly is they will previously choose investments that follow specific criteria to promote sustainability. In 2023, domestic inflows amounted to more than $1 trillion.

Leveraging Big Data for Market Insights

In the digital age, big data has become a crucial resource for generating market insights, providing a competitive edge to investors by enabling the analysis of massive volumes of information at unprecedented speeds and accuracy. Big data analytics harness diverse data sources, from financial markets to consumer behavior, to inform more robust investment strategies.

Advanced Analytics Techniques

Utilizing advanced analytics techniques such as machine learning and predictive modeling, investment professionals can uncover hidden patterns and correlations in market data that would be unnoticeable with traditional analysis methods. For instance, by analyzing real-time data streams from social media and news outlets, AI models predicted a 15% increase in tech stock prices during the launch of a major product, allowing investors to capitalize on this movement before traditional signals could catch up.

Real-Time Data Processing

The ability to process and analyze data in real time is transformative for investment strategies. Big data technologies enable the monitoring of market conditions continuously, providing investors with the capability to make decisions instantly as market dynamics change. This real-time analysis supports dynamic asset allocation, helping to maximize returns and minimize risks during volatile market periods.

Behavioral Analytics

Behavioral analytics delve into the psychological factors influencing investor decisions, combining big data from trading platforms with insights from behavioral finance. This approach has proven effective in predicting market movements based on irrational investor behaviors, which are often overlooked by conventional financial models.

Enhancing Portfolio Diversification

Big data also facilitates enhanced portfolio diversification by identifying non-obvious correlations between different asset classes. Through sophisticated data analysis, investors can find unique diversification opportunities that balance risk and reward more effectively, tailored to specific investment goals and risk tolerances.