The Path to Millionaire Status Through Stocks

Since stocks are a common way to build wealth, the question arises whether investing in them and under favorable conditions will turn you into a millionaire. If we talk not only about investment options but also delivery, degree of discipline, certain time, condition of the market, and other factors all play a huge role. How can this fortune turn to be a reality? It is vital to know and understand basics.

First and foremost, you need to know fundamentals. Shares are associated with some part of the owner’s company. By purchasing one, you also invest in the firm’s future profit and long-term growth. The average annual real return of the S&P 500 over time has been about 7 to 10%.

After you decided on the goals and chose a particular stock, think of regular investment. Take for instance that you invested $10,000 and would be able to set aside another 500 monthly at an 8% average ROI. In this case, it will take you about thirty years to accumulate this principal via compound interest. It is an option to visualize in which way the compounded results will elevate return and make your dreams come true. On the other hand, do not forget about levels of diversifications and the amounts of risk they include within the stock exchange.

Opt for investing long-term. This yields more than short-term investing. You can invest by targeting a fixed payoff schedule. It is also possible to offset the risks while maxing out the likelihood of high returns by applying for a little at a time according to the principle, referable to cost averaging, from this advantageous advantage.

As ever, be prepared to change plans and be flexible. The discipline predominant is never above any emotion. The dynamics of the stock market cause highs and lows the hobbyists find in avoiding common breakdowns. It may lead you to a frenzy that you would like to dump that stock immediately. It is much smarter to wait during low seasons for the right moment and accumulate the cash necessary to make the purchase. Plus, the correct investment model increases your chances to own millions sometime soon. An investor can take advantage of accumulating at the lowest price. When you make the investments regularly it is easier to track the investment and manage the dynamics.

Learning from Warren Buffett’s Approach

Warren Buffet, one of the most successful investors in the world, laid out the core concepts of achieving substantial profits in the stock market. His method is a combination of value investing with his characteristic long-term approach. I believe that examining his process would provide vital clues that would help me get rich and achieve my goal of turning into a dollar millionaire via stocks.

A Value Investing Principle Based on his preference of holding stocks on a long-term basis, Buffet’s method is tied to value investing core concept. According to some sources, he has noted “our favorite holding period is forever” when speaking about his approach. One of the best examples of this concept would be Buffet’s investment in Goldman Sachs during the peak of the financial crisis or at troubled times for the company. Buffet spent $5 billion to invest in the bank, by that risking falling rates and losing it all. However, the market was mistaken in assessing the company, and Buffet’s chosen stocks increased in price. Now, the planned 10% remuneration presented in the form of dividends for Goldman Sachs’ shares is among the most profitable deals in the investor’s history.

The Moat Idea One of the key concepts of Buffet’s strategy is to search for the companies with the biggest “moats.” According to him, the moat is a competitive advantage that protects the company from its competitors. For instance, the close fan community that is excited able actively researching the new technologies and potential success is Apple’s moat. Its key idea works well and helps the management to maintain the profit margins and stay ahead of its competitors.

Management Quality I believe another critical concept highlighted by Buffet is the importance of the high quality of a company’s management. In the light of the skepticism of most executives about cryptocurrencies, I examined different APPs and social networks visited by leading players of this area. In addition, the study of the company’s executive board leader in this area was also carried out. I realized that their potential leader is Tim Cook, head of Apple. Cook’s leadership and the company’s accomplishments under his guidance indicate that he is not an ignorant man.

Peter Lynch Philosophy of “Invest in What You Know”

Peter Lynch’s philosophy of investment states that an ordinary stockholder has advantage in front of Wall Street since his consumer experience may warn him of companies to invest in. Therefore, your thousand-dollar portfolio gets growth odds of millions. Here is how you can implement Lynch’s insights when working on your millionaire-status plan given your investments in stocks.

Rely on Your Personal Experience

Peter Lynch claimed that the best stocks can be selected through one’s own consumer experience. For example, if you see that a brand is sold out sooner than other brands, get some feedback as you make a purchase, and choose that company as the one in which you can invest. Lynch learned that L’eggs pantyhose, for the production of which Hanes was contracted, was very popular not least due to the times his wife bought a pair. Sitting in front of the stocks monitors, he thought: “Thousands of millionaires were wearing them in jeans, and I’m the biggest jerk in the country to look at the Daily Quotes”. Then, he visited Hanes and decided to buy in on his experience along with the views of production managers’ wives. However, you should not invest in a dozen companies – instead, investigate each the way you studied the one, millions of which you made on consumption.

Analyze Fundamentals

Lynch stated that by analyzing some simple financial indicators, one can make no big mistake and understand if there are growth potentials in the company. Find companies with decent earnings growth, return on equity above 17%, and earnings to price ratio of about 1. Growth tells you that the company is doing fine, return on equity reflects good management and valuable possessions, and a one-to-price ratio says that you pay one dollar for a dollar’s worth.

Find the “Ten Bagger”

In your pursuit of “ten baggers,” turn to your understanding of the next row companies which you think are going to revolutionize the industry . It can be your local company turning into a national, or higher, for instance. Stocks frequently used in financial news or in which companies are in booming industries are not likely to be high-growth potentials.

Ray Dalio’s Principles of Radical Transparency

Ray Dalio , the founder of Bridgewater Associates, one of the world’s biggest hedge funds, and one of the most successful investors, attributes his success in investment to radical transparency. Such an approach to investment creates an environment where ideas and the process itself are challenged, and only the best approaches survive. Here is how applying principles by Ray Dalio can help you grow one million from investment in stocks.

Open Environment of Investment

Discuss your investments. According to Dalio, the ability to make the right investment decisions is directly related to the option of comparing different viewpoints on the issue and questioning biases Marinelli . In other words, an investor needs a certain community of investment-minded professionals or acquaintances to exchange news and thoughts.

Data-Driven Attitude

Use data over emotions. According to Dalio, a worthy investment should be made based on data and algorithms, not feelings Marinelli . Thus, if you see that a company’s earning is up each quarter, that company becomes a good candidate for investment despite the recent failure to develop a new product or achieve something else on the market.

Being Criticized

Accept criticism concerning your investment behavior. “Dalio’s thinking focuses on the idea that the best ideas often might sound counterintuitive at first, so to learn something new, you might need to be frequently challenged” Marinelli .

Endless Learning

Learn from the basics endlessly. Ray Dalio applies an analogy that the market is a complex mechanism, which implies the need of endless research of the machine itself Marinelli . This means that a person does not stop reading and watching over finance and learning the nature of money and financial assets.

Balanced Attitude

Diversify your attitude. When choosing between different portfolios, one should carefully analyze how they would impact the risk the investor takes taking that decision, and whether that approach is balanced or not Marinelli . One of Dalio’s principles is the principle of decision making when all involved agree on their expertise level, and the decision power is divided proportionally Marinelli .

The Long Road to a Seven-Figure Portfolio

In conclusion, a million-dollar portfolio realized through stock investing does not require just knowledge and experience but also time, discipline, and strategic planning. It is quite a long-term and hard challenge to meet but is quite possible using appropriate methods and techniques. Namely, it is advisable to consider the critical steps that have to be made to develop and sustain one’s million-dollar portfolio.

Start Early and Invest Regularly

The notion that the sooner people start, the better it is, is valid not only in this case but also in others because of the compounding returns, which means that the more time an investment has, the more it grows. For example, people may invest $500 a month at an 8% annual return, and by the time they are 65, their investment would be over $1 million. In addition, regardless of market indexes, the key is to invest regularly.

Use Tax-Advantaged Accounts to Make Taxes Work

People are advised to contribute as much as they can to tax-advantaged accounts, such as IRAs and 401k. They may not have to pay taxes on the gains, which makes the investments grow much faster. For example, even if they contribute the maximum to a 401k account over a few decades, especially when the employer matches contributions, the portfolio is likely to reach over $1 million.

Educate Oneself on Various Investment Choices

It is important to gain knowledge and proficiency on different types of stocks, bonds, and mutual funds. People should understand what types of stocks are available and appropriate for their long-term goals and level of risk. For instance, growth stocks have higher returns but are also more volatile, which means that they need a longer period. On the other hand, value companies seem to have more reliable gains that come faster.

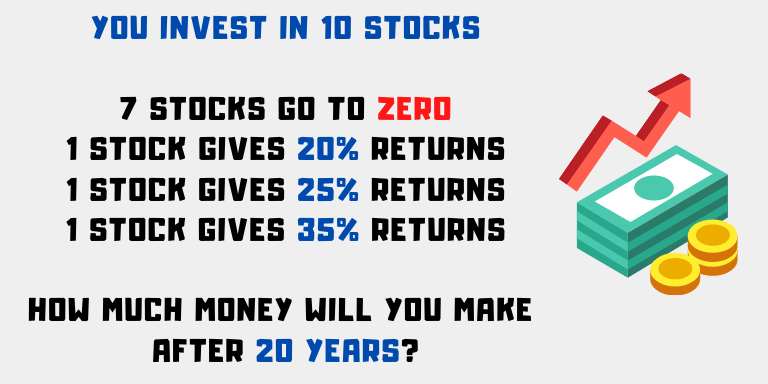

Diversify to Manage Risk

People should avoid investing in only one area of the economy and, instead, they should apply the benefits of diversification, which means investing in many different sectors and types of investments within each overall asset allocation. However, it is not about eliminating the risk, but effectively dealing with it in light of the overall goals and time frame.

Monitor and Rebalance on a Regular Basis

People should review the whole portfolio and rebalance it as needed to ensure the same asset allocation. For instance, if certain equities increase, they might start comprising a greater percentage of the whole portfolio, and thereby, they have to be sold off, and the money gained invested in other sectors and asset classes.

Predicting the Growth Timeline of Investments

One of the most foundational steps of creating a plan to become a millionaire by investing into stocks is understanding how long your portfolio will grow. This ultimately comes down to the knowledge of the drivers of your returns and how to use the information to estimate the rates of return. Here are the main considerations that should be taken into account on the matter.

Compound Growth

Compounding is your friend. The principle describes the process of growing your investment because the earnings on an investment earn interest on account and earnings, which leads to the increase of the value of the other. There are many different formulae that may be utilized to illustrate the effect, but the most basic one is pretty simple. If you start with the $10,000 investment with an annual return of 7%, compounded yearly, your portfolio will grow into $19,672 .

Realistic Return Rates

It should go without saying that the investment target has to be aligned with the investment returned rate. There are numerous references to utilize on the matter, such as the average S&P 500 annual growth, which is around 10-11% for the period of 1926 to 2018 . Inflation-adjusted, the average historical return is also pretty predictable at 7%.

Time to Goal Calculation with no Additional Investments

One of the most important steps on the matter is to estimate time to grow to the needed value. The investment goal type and scale can be taken into account. Meanwhile, the Rule of 72 can also be utilized to estimate the needed time. The number refers to the amount of time that is needed to double the investment. As such, you will have to divide 72 by the rate of return to calculate. If the return is at the 8% yearly rate, the investment will have to wait for about 8 to 9 years. With the same logic, with monthly investments and an 8% average return, you investments of around $10,000 and $500 monthly will reach $1 million in less than 27 years.