US Dollar Index

The US Dollar Index is a foundational financial indicator that represents the strength of the US dollar in comparison with foreign currency. Created in 1973, with a base rate of 100, the Index was established shortly after the introduction of the floating rates in the wake of the Bretton Woods Agreement failure. The Index’s creation was prompted by the necessity to develop a comprehensive method of tracking the performance of the dollar, as well as to assist in the international financial analysis and planning.

Origins and Development of the USDX

The origins of the USDX are closely tied to the international financial environment and its continuous evolution. Originally, the Index incorporated the currencies of the primary trading country’s partners, Germany, France, Sweden, Switzerland, Japan, Canada, and the United Kingdom. However, the introduction of the euro in 1999 caused a major transformation. Most of the European currencies were replaced due to their initial inclusion in the euro, which also drastically adjusted the weighting to the present scale. The change is a direct reflection of the growing complexity and interconnection of the modern financial and trading environment. It also highlights the reasons that make the US Dollar Index a valuable financial tool.

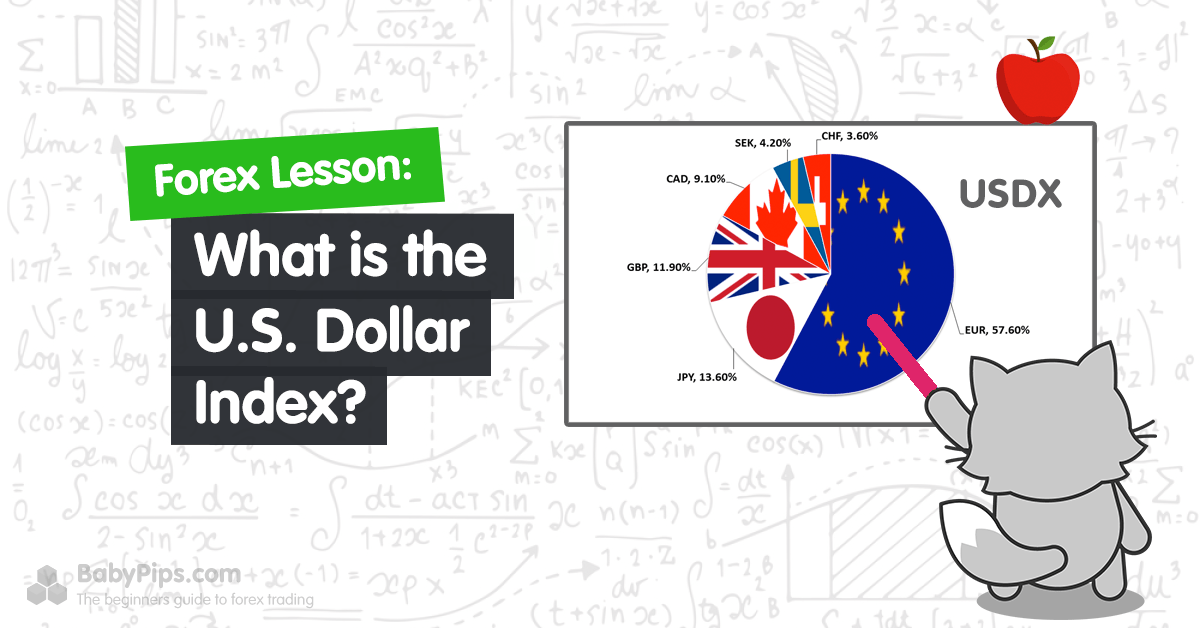

Composition and Currency Weights

The composition of the USDX is a careful selection of currencies that coincide with the United States’ primary trading partners. According to my most recent sources, the Index includes the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. The Index is heavily weighted towards the euro, with an impressive 57.6%. The Yen and the pound are second and third, with weights of 13.6% and 11.9% respectively. Despite being less weighted, the remaining currencies serve an essential function in maintaining a balanced Index that provides an accurate picture of the dollar’s position and scale on a global level.

Dynamics of the Dollar: Calculation and Interpretation

The USDX is calculated through a highly complex formula. In the broadest terms, it measures the performance of the US dollar not separately but in conjunction with the valuation of multiple other global currencies relative to the dollar. In other words, the dollar performance is measured against a currency basket, which in this case includes six primary medium of exchange around the world. These currencies are evaluated in respect to the dollar according to fixed weightages known exclusively to the Federal Reserve Board. The formula multistage and depends on the current exchange rates to put these numbers into proportion. In a very simplistic view, the index value rises when the dollar value increases concerning these other currencies and falls when its valuation decreases. Subtle and abrupt changes in this scale indicative of the changes in worldwide performance of the US economy, global economic changes as a whole, and even relevant monetary and fiscal policy changes. As far as investors are concerned, a generally rising index might imply the bullish market confidence in the dollar attractiveness, while a continuously falling index might lead to falling long-term investor confidence and a certain strategic departure. In addition, some of the most well-known examples for such movement are the USDX hitting the historical maximums beyond 160 in the early 1980s, due to high-interest rates and the spiraling upward growth of the US economy and dropping to the minimum value of near 70 in the period of 2008 global financial crisis.

External factors that determine USDX

Geopolitical events influence a lot of USDX movement. Trade wars, crises, political instability, and other events might impose new beliefs on the market and contribute to the index’s movements. Central bank policies, especially FRS and ECBs, that determine the change in interest rates and shapes a new monetary policy and might impact the USD. Commodity price levels can affect it too as oil is usually discussed in dollars. So, the presentation of the index will be shaped enormously by external factors that are not under a particular country’s control.

Trade relations on a global level

USDX is all about trade relations as if USD strengthens these arrangements, then the sum and considerations and payoffs will be such that far. So, USD is proportionate to income: when USD strengthens, the prices of US products increase, and they become less competitive; when they weaken, the prices of goods produced in the U.S. decline, and this benefits the trade balance. There are frequent interrelations with imports and exports between several countries, which shows that understanding how to impact these relations and make import and export arrangements between countries is crucial for business and policymakers.

Options and strategies

Understanding that the final destination is far from the starting point, financial markets resemble boats in vast and formidable waters. The leading technologies developed to support this career have become investment tools like options, futures, and ETF. Options present not only a return but also an important compensator of the market volatility movements, and currency futures allow professional income to lower volatility copying. It is especially efficient for people who want to optimize their exit conditions from the positions of the general portfolio or trade in financial profit.

Introduction

Futures and options are two key instruments for hedging, speculating, and diversifying portfolios. A futures contract is a commitment to either purchase or sell an asset on a future date for an agreed-upon price, providing a cost-effective way to “lock in” prices of commodities or financial positions. On the other hand, an option provides the investor a right to buy or sell an asset (call and put options, respectively) but not an obligation. Both futures and options rely on complex pricing models (Black-Scholes for options) influenced by a number of variables and decisions. In trading these instruments, it is also important to have a clear understanding of the role of leverage and its effect on both profitability and losses.

Exchange-Traded Funds (ETFs)

Exchange-Traded Funds have significantly modernized trading and investment by making a combination of the principles of mutual and high-frequency stock trading. ETFs reflect an index, asset, or commodity price or a bond usefulness and are traded on exchanges like stocks, offering the same daily pricing and availability throughout the day. What makes ETFs attractive to buyers is their relative transparency, lower expense ratios, and tax advantages. For traders, it is imperative to understand the ETF’s underlying asset or trend and be familiar with the bigger-picture application of the data.

The outline of a strategic trading plan begins with making clear and achievable objectives. After that, a trader needs to know the amount of risk on which he/she is able to embark. The trader then critically evaluates the market situation, trying to predict the potential unfolding of the circumstances. The components of a strong strategic trading plan include distinct entry and exit tools and risk control measures, such as stop loss. Finally, the adequacy of a strategic trading plan fully depends on one’s trading personality, and so, such a plan should be reviewed often, taking the results as a foundation. The whole strategy is based on the rules and leads to discipline and confidence.

The Strong Dollar

The strength of the major reserve currency goes far beyond a mere indicator. Instead, it serves as a clear reflection of current global market conditions and participants’ confidence in financial markets. The dollar firmly holds its position as the world’s leading foreign exchange reserve, and so, its stable, weak, or reinforced value has a significant impact on the balance of trade, capital and investment contributions, and even the national currency of different countries. Investors, policy-makers, and leaders make great use of the domestic market factors to determine the risks, develop strategies, and make a proper decision in the long run.

There is a close correlation between the U.S. dollar’s value and the performance of the nation’s economy. The main features likely to bring about the increased value of the U.S. dollar are the nation’s steady GDP growth, low unemployment rates, and formidable consumer spending force. As a result, it would seem less risky to invest in the capital of this country since the economy remains flawless. On the other hand, it is always considered risky to invest in a struggling economy, which is why the value of the US dollar would decline: sounds like a widespread practice across the world, it is of vital importance to be aware of the existing economic indicators as early indicators of potential monetary policy adjustments.

The effect of the forces is noticeable, particularly on US international revenue and competitiveness among US international trade. This is because of the fact that a strong dollar makes products from US-based multinational corporations more expensive than all comparative products from other nations. The risk affects trade balances, force avoidable changes in pricing, manufacture, or supply and lead to non-market ventures moving changes in US-based corporations’ or the countries’ international economic target strategies. It is also important for wily business owners and investors as they follow the dynamic global arithmetic to avoid owing these contingencies’ damaging effect has on individual profitability. The Federal Reserve’s role can also affect the strength of a dollar. Some of the fundamental tools that the ‘Fed employs and can affect the US dollar are the adjustment of interest rates.

Using the U.S. Dollar Index (USDX) as a guide, and an investment platform can be strategic and rewarding. As a traceable benchmark index that evaluates the USD’s relative value based on other dominant world currencies, its unique attributes can protect one’s investment portfolio from any significant dollar drop, unlike any other emblematic asset. Using the USDX as an investment enables one to gain possible capital from any honorable increase in the US currency even though it is linked to other nations’ fall in either inflation or currency valuation. Static investments for intending investors range from interest bearing saving or fixed-income bonds and all instruments similar. Since the bank sets a fixed interest rate regardless of its performance in the economic recession, the bank assumes a 5% share in all the profit. Alternative and viable ventures for the investment of $100,000 open include startup companies, personal loans to trustworthy individuals or companies, and the purchase of tradeable BTCs.

Hedging and speculation opportunities

Hedging. The USDX is a versatile instrument that allows hedging against fluctuations in the dollar’s value. At the same time, many traders and investors hold their assets in foreign countries. These assets can be, for example, real estate or company shares. In this case, the USDX helps protect their equity from negative currency changes. Thus, if they have their wealth in another currency, then the fall or increase in the value of the dollar will not affect them. These investors exploit the hedging ability given by the USDX.

Speculation. Another advantage is opportunities for speculation. If the investor takes a speculative strategy, it will use the ability of the USDX to benefit from predictions regarding the state of the US economy and its currency. Besides, the investor will be able to make a correct forecast for other world currencies. Investors can also calculate their profits using the index multiplier. Thus, having this indicator allows investors to simultaneously make different investment decisions. For example, it can create a position that benefits from the strengthening of the dollar and invest in companies that will benefit from the strengthening of other currencies.

Drawbacks of the dollar index’s structure

One of the components of the index, the euro, accounts for too much of the total index. Thus, the index emphasizes the degree to which the dollar is subsequently proportional to the euro. Many traders believe the USDX is primarily a trade-weighted indicator. This drawback affects how accurately the index reflects the dynamics of dollar value against a broader array of currencies. At the same time, there are many emerging market currencies that are not included in the index. Thus, in this case, the index does not consider developments that may impact significant growing regions. Finally, the investor should be able to adapt his strategies to changing currency market conditions.