Mechanisms of Bond Income

Among other investment tools, bonds have always been highly popular seeing that they have the potential to produce regular income and give a fundamental understanding that it is possible to use them as risks reducer for a diverse portfolio. In this way, if one wants to diversify investment strategy learning in depth how bonds create revenue is critical. Let’s go over the mechanisms of creating income for bondholders.

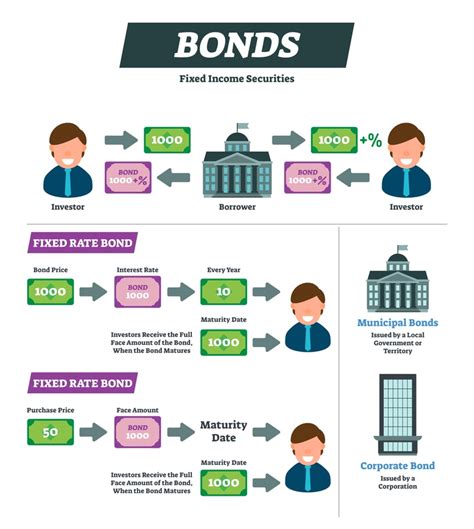

Interest payments – the core of bond income

In the heart of bond income are interest payments, also described as coupon payments. In simple terms, bonds can be regarded as loans provided by investors to issuers – no matter whether they are corporations, municipalities, or governments. The issuer, in turn, promises to give back the loan’s amount or principal on a specific date which is called maturity and to pay regular interest throughout the bond’s life. The rate at which the interest is calculated or the coupon rate is usually fixed at issuance. As an example, let’s assume that the bond in value of $1,000 has a 5% coupon rate; it will, therefore, pay $50 each year and as long separately staying as it does not mature and is not paid back. Notably, the value of new issue fixed-income securities is almost always set at $1,000, while one can get them either at this rate or with a mark-up or discount depending on the bond’s market value.

Price appreciation

While it happens much less frequently, bonds can also create income through price appreciation, in particular, if the value of acquired bonds grows above the price one paid for them. Price appreciation is observed after a reduction in market interest rates or a rise in the issuer’s credit rating. For instance, if before visiting the market the interest rates were 5% and then they dropped to 4%, then a bond giving 5% interest becomes more valuable as it will pay more than new and current issues.

Yield to Maturity: The Most Complete Measure

Yield to Maturity is a principal concept yet for it can combine current income and any gain or loss realized at maturity. It is demonstrated in the form of an annual rate. The YTM is calculated with the knowledge of a bond’s current market price, par value, coupon rate, and time to maturity. I have decided to include all of these concepts in different measures, and this is the final one that shows the investors a full picture of what they can earn by holding the bond until maturity and being repaid, in full, for their investment.

Tax Implications

The net return of bond income can vary with the help of many existing tax implications. In the majority of examples of interest from bonds, this income is subject to federal income tax and sometimes state income tax too. For example, interest income from municipal bonds is tax-exempt at the federal level and sometimes at the state level and is not attached to some kinds of local taxes for those investors who reside in the state of issuance. These implications explain why it is especially demanded by people in higher tax brackets and should be taken into account by potential investors. These kinds of instruments help investors to reach a variety of financial goals. They are able to find ways to provide themselves with an increasing price and steady income streams, as well as take advantage of the tax-exempt interest.

Interest Payment Calculation

Of course, the last thing I could have excluded from the list was the issue of how interest payments can be calculated. It is connected to the income bonds can potentially supply their owners with.

Calculating Interest Payments and Determining the Coupon Rate and Payment Frequency

The first step is to examine the bond’s coupon rate. The coupon rate is the interest rate the issuer agrees to pay bondholders. This amount is generally expressed as a percentage of the bond’s face value and paid on a set payment frequency. It is important to note that not all bonds have a fixed coupon rate, as some can be adjusted. However, most traditional bonds do have fixed rate. The other critical piece of information to know is the payment frequency. It appears that most bonds pay interest twice a year, while some may pay quarterly, monthly, or annually. This will greatly determine the amount of money I will receive each year. The formula for calculating interest payment is very simple, as all I have to do is multiply the coupon rate and face value by the number of payments per year.

- Interest Payment = (Coupon Rate / Number of Payments per Year) * Face Value of the Bond

if I have a $1,000 bond with a 5% annual coupon rate that pays semiannually, then I will receive (0.05/2)*1000 = $25 every six months until my bond has been fully matured.

Finally, the “face value”, or principal value, is the amount the bond will be worth at maturity. This amount is used to calculate the interest and is the amount on which periodic interest payments are made. It is important to remember that the face value is not always the amount I paid for the bond. For example, premium and discount bonds cost either more or less than the face value. Finally, the yield, either the “current yield” or the “yield to maturity”, refers to the amount of money the bond will earn.

Market interest rates directly affect bond prices. The rate of interest on newly issued bonds is higher in the market when there is a rise in interest rate in the market. The newly issued bonds become more lucrative and the bonds already present in the market become less attractive because the prevailing rate of interest in the market is lower as compared to the newly issued bond. The result of increased interest rate on the newly bond is that the older bonds lose their value in the market.

Understanding the relationship between different components of a bond and the correlation between them will enable the investors to take necessary measures to ensure the highest possible income from the bond and even to take appropriate decision to modify the strategy of investment with the change in market position. Zero-coupon bonds do not offer any periodical interest on the investment, but rather these bonds are issued at a discount to the face value and the zero-coupon bonds are redeemed in the end at the full face value. This discount received and the amount received at the end of the period will represent the income of the investors. Zero-coupon bonds are nifty investing option to properly comprehend for the investor to safeguard his interest by planning the investment in varied options or even planning so that an amount can be received after a specific period from the date of investment.

Calculating YTM

The yield to maturity on a zero-coupon bond is very important. It reflects what the bond will yield if it is held to maturity. In order to calculate the Yield to Maturity, it is necessary to know the purchase price, the face value, and the time until the bond matures. The formula for calculating it is fairly complex, as it must also account for the increased value of interest over time. The formula for calculating the yield for a non-coupon bond is:

- YTM = [(Face Value / Purchase Price)^(1 / Number of Years to Maturity)] – 1

Tax Issues

Phantom income is a little too harsh of a term, but zero-coupon bonds are considered to be a form of phantom income. That is to say, the IRS charges a tax on the “imputed” interest income to the bondholder, even though the bondholder does not receive the increase in cash. This is payable each year and is to reflect the increase in value of the bond each year the bondholder owns it.

Advantages and Risks

Zero-coupon bonds are quite a good investment because they stimulate the leisure to come with the fact that the yield and the eventual big payoff are both known in advance. They are also good for long-term investments, and very popular in their role as an investment for paying a child’s way through college. One of the major risks is that the money is tied up with the federal reserve until the bonds mature. Also, because they are discounted far lower than normal bonds, they tend to be a lot more volatile in response to changes in the interest rates. A rise in the interest rates can have a devastating effect on the value of the bond. This is why zero-coupon bonds must be reserved for specialist investors who do not need the bond’s value before its end date.

Coupon-Paying Bonds

Coupon-paying bonds are the original players in the bond market, offering investors a regular income source in the form of interest payments. The bonds are named for the “coupons” once clipped from the physical bond certificates and cashed in for interest payments. Nowadays, the process is digital, but the idea remains the same – bondholders receive regular payments based on the bond’s coupon rate until it matures. When it does, the principal amount is also repaid. Fundamentals of coupon-paying bonds are relatively simple, but they are a fundamental knowledge base for every investor when considering the purchase of fixed-income securities.

Coupon Rates and Payments

The coupon rate of the bond defines the interest income paid to the bondholder periodically, usually annually, as a percentage of the bond’s face value. This rate is set at the issuance of the bond and does not change throughout its life. For example, a $1,000 bond with a coupon rate of 5% will pay the bondholder $50 annually until the bond’s maturity. Payments are usually made semiannually, even though some bonds pay quarterly or annually. Trying to develop a reliable coupon strategy, investors should also consider the payment frequency as it directly influences the investor’s cash flow.

Pricing and Market Value

The market value of a coupon-paying bond varies depending on such factors as interest rates, credit rating, and other factors. The bonds are often traded either at premium or discount to the bond’s face value depending on the coupon rate and the market interest rate. If the former is higher, then the bond is sold at a premium and vice versa. For instance, a bond paying 6% interest could be sold at a premium if current interest rates are lower.

Yield Measures

Several yield measures including current yield and yield to maturity are utilized by investors to evaluate the return on a coupon bond. Calculated by dividing the annual coupon payment by market price of the bond, current yield measure offers a picture of the income generated to the investment cost at the given time. Yield to maturity measure is broader in scope as it addresses the return an investor will earn if they bought a bond at a discount to the par and held it until the maturity date. Such total return measure considers interest payments as well as the gain or loss from returning the bond to the issuer having worth less than the par or reselling it to another bondholder at a premium yield.

Risks and Considerations

While coupon-paying bonds are generally considered safe investment tools, there are certainly several risks associated with this type of bonds. Interest rate risk exists because of the potential decrease in market rate of return. This, in turn, decreases the value of the bond and the return on it, subsequently. Credit risk implies that the issuer will not honour the commitment of repaying money borrowed through issuing the bond. The degree of this risk is considered higher in case of corporate as opposed to governmental bonds. Reinvestment risk occurs in the scenarios of dropping interest rates, which forces the investor to reinvest their coupon receipts in a bond that has a lower yield rate.

Conclusion

Coupon-paying bonds offer a reliable income source that is not difficult to realize. It is often a safe investment that has a place in nearly every investment portfolio. At the same time, it is important for investors to be aware of situational market value of the bond following reserved coupon rate and its yield relative to their risks to avoid making irrational financial decisions.