Understanding ETF Pricing

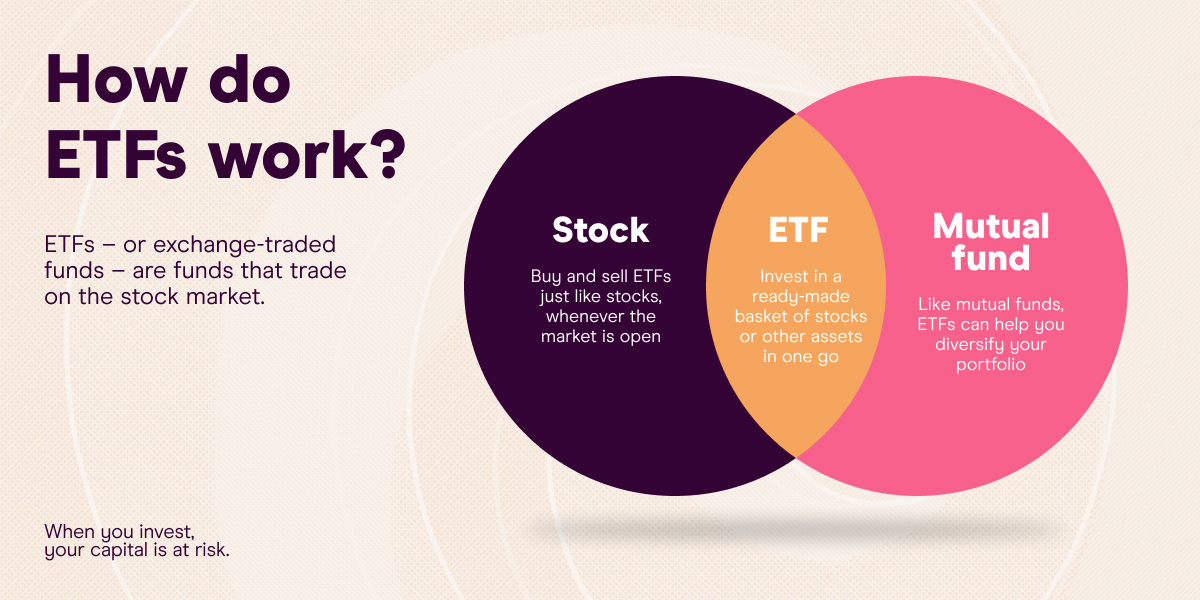

Exchange-Traded Funds (ETFs) are a versatile financial product that combines the diversification status of mutual funds with the ease of trading associated with stocks. Because of this, ETF prices change throughout the trading day as a result of responses to supply and demand exactly in the way stocks do. This is in stark contrast to mutual funds, which are only priced based on the end of the trading day; in case of ETFs, if there is higher demand for a certain volume, the price at which it is being sold will be increased, which will alter its price throughout that day. Generally, the price of an ETF should be expected to vary towards the end of the trading time, when the actual number of buyers and sellers will be formalized and the demand number will be calculated as there will be no trades to buffer the gap between the official demand value and the supply and the resultant expectation values of the fund, and the volume will be priced according to that number.

The Bid-Ask Spread

The bid-ask spread is an important factor in ETF trading, because the wider the differential between the bid (the highest price a buyer will pay) and ask (the lowest price a seller will accept), the more a trader will have to spend on transaction costs. The spread on popular ETFs should be very low – often too low to be expressed in more than a few cents – and may even be cognitively calculated as being, in fact, zero, as the liquidity rate is high. However, the spread on ETFs that are not as popular will be wider, as they will have lower liquidity, and a trader should always strive for as low a spread as possible.

How to Time ETF Trades

The best times to trade ETFs are usually in the middle of the trading day. The worst times are the market open and close when volatility is the highest. This also leads to smaller price fluctuations helping in minimizing the impact.

Understanding the Trading Volumes

This is a key indicator of an ETF’s liquidity. One can also compare the trading volumes to the ETF’s average trading volume, to ensure it matches with the investor’s liquidity needs before trading the same.

Understanding the Use of Limit Orders

By using limit orders, traders ensure that they do not pay more than the maximum price they are willing to pay. Furthermore, during the process of selling, they will receive no less than the minimum price they are asking for the ETF. This becomes very useful in a highly volatile market or for an ETF that has a broader bid-ask spread. Hence, the traders can limit their risk through limiting the potential cost and avoiding unfavorable prices simultaneously.

Understand Market Makers

Market makers in ETFs commit to facilitating trading in a specific ETF. Their profits come from the bid-ask spread. The market makers will maintain reasonable bid-ask spread prices for buying or selling the shares.

Assessing the Net Asset Value

Net asset value is the per-share value of an ETF or mutual fund. It is calculated by taking the total value of all the securities in the fund and any additional assets, subtracting against other liabilities and then dividing the same by the total number of shares outstanding. Investors look at the NAV to identify how much a fund is worth. Let us understand the process of calculation of NET and its components.

Relationship with the Market Price

Many ETFs do not trade strictly at NAV, as is the case with stocks. However, their market price can differ because of their being traded. The ETF might trade at a premium or discount, depending on the supply and demand. Investors can buy or sell shares when the latter are below or above the fund’s NAV, respectively. For example, waiting until the ETF trades below the NAV might be a good buying signal if the stocks it trades are relatively stable.

Daily Updates

Mutual funds compute their NAV on the end of every trading day as they have to wait until the markets close. In contrast, as it was briefly mentioned before, ETFs provide intra-day NAV approximations. However, the official NAV calculation for ETF occurs at the end of each day, similarly to mutual funds, which means the investors have to wait to see how much their assets are really worth.

The Impact of Dividends and Distributions

Dividends or distributions of a mutual fund can change its net asset value. Therefore, when a fund distributes dividends, its net asset value goes down by the amount of the dividend per share. It is important for the investor to consider the dividends or distributions because the drop in the NAV reflects on the value of the fund overall but not its performance.

Use of NAV in Investing Decisions

The net asset value reflects the per-share value of a mutual fund and is useful in determining the amount of fund an investor can hold. However, the effective investors tend to use other factors in determining the investment portfolio, such as the historical long-term performance of the fund, its expense ratio, and the specific sector in which the fund invests. It is also important to consider the net asset value of the same fund over certain times to determine whether the fund has been managing its assets properly. In addition, the use of bid-ask spread allows the investor to evaluate present trend of the sector in which the fund invests.

Fluctuation of the NAV and Investors’ Moves

The net asset value fluctuates based on the movements of the market as well as the performance of the assets that the fund has invested in. Therefore, the investor that follows the net asset value of a mutual fund can better decide when to buy into a certain fund by purchasing it only when it presents better NAV than it has ever had. It enables the investor to align their investments with their strategies.

One of the key factors that determine the size of the bid-ask spread is the level of market liquidity. For this reason, the markets for major company stocks and popular ETFs, which are enjoying high liquidity because of being actively traded, are characterised by a small spread. In contrast, the spreads of thinly traded securities can be much larger. At the same time, time of a day is also important for liquidity since the spread is usually wider when outside of the key trading hours. Volatility is the other crucial factor because when the market is volatile, traders are exposed to higher risk which means that they will require a bigger spread to compensate such risk. Finally, spread is impacted by market makers who offer liquidity by conducting both buy and sell trades from their own inventory. In contrast to other traders, they are interested in the spread to be as wide as possible in the volatile markets to reduce their own risks. Calculated bid-ask spread.

However, the bid-ask spread is easier to calculate because it is equal to the ask price minus the bid price. For example, if a stock has a bid price of $100 and ask price of $100.20, the spread is $0.20. This figure represents the cost to investors because in any case they will have to sell the stock below the initial purchase price. Dealing at the bid is the only way to avoid this cost, and most traders have to interact with the asset eventually. Ways to reduce the costs associated with bid-ask spread.

From the investments perspective, the bid-ask spread presents a significant hidden cost because a trader buying an asset at the ask price and then selling it at the bid price will suffer a loss equal to the spread. Namely, the stock should appreciate at least by the same amount as the spread to return at the purchase price. Various strategies can help to deal with the costs associated with the spread, with one of the most effective being the use of limit orders that enable traders to define the price by which they are willing to buy or sell an asset.

Reading Market Depth

Reading Market depth charts provide information about the bid-ask spread as they display the number of buy and sell orders at varying price levels. Analyzing these charts helps traders to understand the amount of buying or selling pressure. Consequently, traders can use market depth information for predictions, thereby, gaining an advantageous position. Bid-Ask Spreads and Market Sentiment.

It is necessary to note that the bid-ask spread can also represent traders’ sentiment towards a particular security. A wider spread often presents the fact that there is too much uncertainty or disagreement with the initial price. Conversely, if the spread is relatively narrow, traders show that they agree on the real value of assets. Identifying Ideal Trading Times.

Understanding the optimal time for trading is vital in the stock market characterized by major liquidity or illiquidity and movements. In other words, the opportunities vary considerably depending on the time. So, it is necessary to know precisely when to trade and why such time is optimal. Getting to know these essential details require understanding market hours’ peculiarities.

Understanding Market Hours

The market’s operational hours are from 9:30 AM to 4 PM Eastern Time. Nevertheless, not all hours are the same since each market hour has its opportunities. The most critical periods for trading include the market opening and closing hours, 1st and 2nd hours to consider for trading are. The Opening Rush.

The market’s first hour after lunch offers the most liquidity and volatility since overnight news and events significantly influence decisions made at the first hour. Ending the lunch sometimes leads to major gains on stocks; however, because the market’s initial volatility absorb new information, traders need to be cautious.

Typically the market calms down in the Midday.

(11:00 AM – 2:00 PM)

This is when the east coast is heading to lunch.

Most traders are on their lunch breaks, so trading volumes are lower relative to the opening time.

The Midday time is more predictable, and it is less hazardous for a new trader.

There are fewer volumes and opportunities for profit, but it is also safe and smooth.

The Closing Surge.

(3:00 PM – 4:00 PM)

Closing hours are also more energized.

Most mutual funds and portfolio managers rush to ensure that they close the day on a good scale.

They make trades during this time to make sure they can close their positions and balance their portfolios in anticipation of tomorrow.

It is possible for a trader to catch movements during this surge.

The best days to trade

There are days of the week that are better for trading.

Monday is the worst since it is often a reaction to news over the weekend.

Thursday is a good day since the week is almost over, and it is a good day to muster and make plans for the next day.

Friday is not an excellent day either since there is the danger of large investors closing their positions over the weekend.

Midweek, more precisely Tuesday and Wednesday, are safe and stable for trading.

There are fewer chances of surprises when trading on these days.

Seasonal Adjustments

Certain times of the year have more volatility.

It is wise if trades remain inactive at the end of the year.

Institutional investors usually rebalance their portfolios, and the end of the quarters is always more volatile. The summer, however, is always a bad time to trade, and the best thing is to hold. It may be due to the reality that many people are usually on holiday, and liquidity is always affected. Trading on holidays like Christmas and Thanksgiving is not advisable as there is no volume.

Global Market Hours

If you are trading international stocks or currencies, having in mind global market hours is essential. When the New York and London stock exchanges, for example, that trade related securities, such as the stock of the same company, are often more liquid and more on the move. It provides an opportunity for you to benefit from the global event planning trade around these overlaps.

Strategies for ETF Trade Execution

Exchange-Traded Funds (ETFs) have become an essential part of many investors’ portfolios due to their liquidity, diversity, and relative cheapness. However, in order to trade ETFs effectively, one should plan the trade in such a way that the entrance and exit points to minimize costs and maximize returns.

Timing

One simple way to reduce the costs associated with the trade is to time them optimally. The best time to order the ETF is when the trading volume is the highest, within the first half an hour of the opening market hours and the last one. However, be aware that the last half an hour can also be quite volatile, and you can expect less predictable pricing. Trading during these times also use shrink the bid/ask spread.

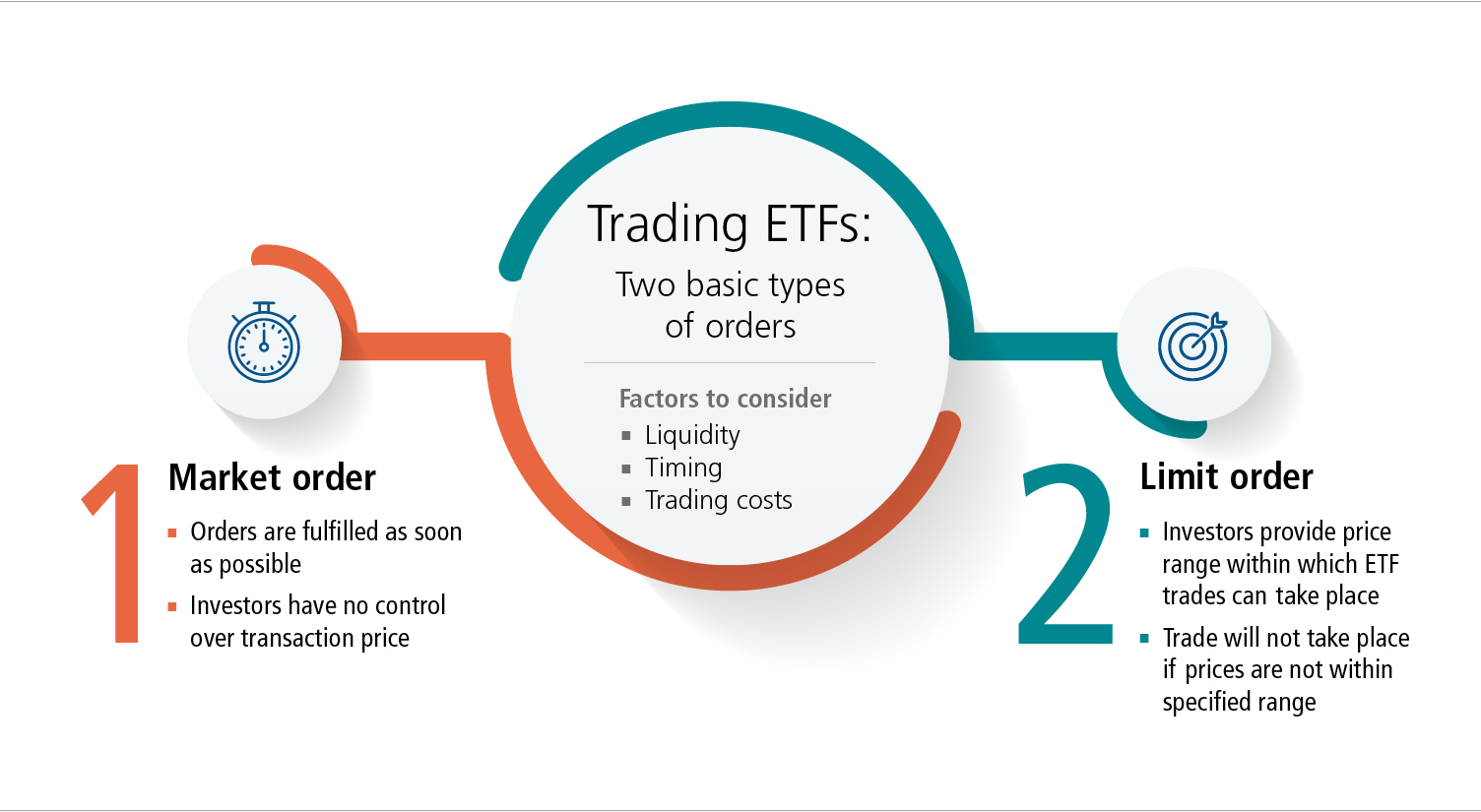

Limit orders

A limit order is a type of trade when you specify to your broker the maximum price you would like to pay for buying the ETF or the minimum price you would accept for selling the ETF. In other words, limit orders give you control over the prices you get, and for larger trades where market orders can move the stock price considerably against you, limits orders prevent you from overpaying in a rapidly moving market. However, be aware that your trade may take longer to execute or never may be executed at all.

Analyzing the Bid/ask Spread

Before you exercise the trade, always analyze the bid/ask spread of the ETF. A narrower spread usually means there is more liquidity and fewer costs of trading. For ETFs that you plan to trade a lot, you may also try to dig into the historical information regarding how high the spread was during previous trading sessions of the same fund. If you plan to frequently trade the ETF with wide spread, consider if the increased expense is within your investment plan and strategy.

5 Tips for Safely Trading ETFs

Evaluating Market Impact

Large orders can move the market, especially for less liquid ETFs. To minimize this impact, consider breaking up large orders into smaller, staggered trades over time. Using a VWAP strategy can also help, since trades will be spread throughout the day to blend in with the market.

Leveraging ETF Liquidity Providers

For large trades, it can be beneficial to work directly with an ETF liquidity provider or market maker. They may be willing to provide a more attractive price for a large transaction than the driving up the price in the public market. Note that you may need a financial advisor or broker who has direct access to these liquidity providers.

Monitoring Market Conditions

External factors such as economic announcements, geopolitical events, and market sentiment can influence the price of the ETF. By staying informed and flexible with your trading strategy, you can adjust it to changes in market conditions, profiting from volatility or avoiding undue losses.

Analyzing Trading Hours of Underlying Assets

For ETFs holding assets in different time zones, such as international or emerging market ETFs, you can check trading hours of the underlying assets. The prices may be more volatile when the underlying market is on. By timing your orders when both the ETF and the underlying asset is trading, you ensure more transparency and efficiency in pricing.

Setting Stop-Loss Orders

To manage risk, setting stop-loss orders can be beneficial, especially in a volatile market. You will still not guarantee an execution exactly at the stop price level, but you will trigger a sell order once the price moves past your defined level. By doing this proactively, you can protect your portfolio from big losses.

Using Limit Orders

Limit orders are a powerful tool in the hands of both traders and investors. They offer a high level of control over the prices at which a security is sold or bought. This is in stark contrast to market orders, which are executed instantaneously, often to the detriment of the investor, who purchases or sells at the current price without entering a limit for the trade. Here is how to use them most effectively.

Choosing a Price

The point and most significant advantage of using a limit order is the ability to set a price limit. This means that when buying, you place the order at a price below the current market value, and when selling, you set the order price above the present value. This way, you specify the optimal way to yield profits or ensure maximum discounts without having to monitor the price actively.

Benefits in a Volatile Market

A volatile market is characterized by rapidly changing prices that cannot be predicted with certainty. In such conditions, investors are often forced to buy at the peak and sell at the trough, which are the usual outcomes of using market orders. However, the use of limit orders can help protect one’s positions by guaranteeing that the price will not rise higher than the limit for buys and will not fall below the price limit for sells. As a result, using these type of orders in a fast-paced market can mitigate the effect volatility has on your operations.

Strategy

“Using limit orders” is not exclusive to merely setting a price; rather, it is a comprehensive approach. Investors can employ, for instance, multiple orders at different prices to both optimize the mean purchase cost, on the one hand, and scale out of a position, on the other, by moving up the sold amounts. This strategy is especially effective for larger orders or securities where the bid-ask spread is significant.

Timing and Expiration

Limit orders can potentially be placed with a variety of expiration options, in which a day order is one in which the order can expire if not filled by the close of trading day. Similarly, there are also good-till-canceled orders that can remain active for an extended time period, either until it is executed or manually “canceled” by the trader. By utilizing the order expiration in conjunction with the current market condition and events that might affect the stock price, traders can adjust their order to take advantage of opportunities such as broader market trends or particular events.

Limit Orders for Entry and Exit Points

In any type of trading strategy, it is essential to determine the entry and exit points at which the decision to buy or sell is made. By utilizing limit orders, a trader can enforce discipline to this process and ensure that the trader only enters the position when a certain price condition is met or that he will only exit the position if he receives a certain price. Such a methodical approach can be effective in avoiding an emotional decision-making process when a trader is at the boundary of “drawing the line” so to speak in his trading strategies.

Combining with Stop Orders

While a limit order can assist in identifying the price points at which no-trade decisions will be made due to the traders switching their strategy, it is also important to combine this strategy with other techniques that can further improve a trader’s risk management profile. For instance, a stop-limit order can be utilized to execute a limit order when the stock reaches a “stop” price, that gives traders the benefits of controlling the price at which he will sell in a falling market without selling it for a price lower than stop price.

Monitoring and Adjusting Limit Orders

Market conditions change, and while the price limit to buy the stock may seem like a good bargain on one day, as new information arises, the price may no longer be worthwhile. The trader should regularly review and adjust the limit orders to ensure that it still reflects the trading strategy as well as the market condition.