Rate hikes often cause immediate stock market dips. For example, the S&P 500 fell 3.5% within a week of the December 2015 rate increase announcement.

Increased Investor Returns

Historical Trends and Market Responses

The relationship between the increase of interest rates and the U.S. stock market has been examined in great detail, demonstrating a pattern of initial volatility and subsequent varying degrees of revival or downfall. The exact trends are dependent on a variety of circumstances overall economic and business environment and investor mood.

For instance, the increase of interest rates by the Federal Reserve in December 2015 was the first increase in almost a decade. In the days after the decision, S&P 500 was down by over 2%, reflecting client’s fears over the rise of borrowing costs and a potential reduction of the rate of economic growth . According to history, the market began to recover and eventually strengthened, growing by 10% in half a year. The situation in March 2022, when the interest rates were raised for the first time since 2018, was similar in the short term, as the first weeks after the announcement of the increase saw some of the downturn as well, leading both Dow Jones Industrial Average and S&P 500 to fall. However, the market has since stabilized, with one month’s alterations reflecting a surprising resistance of the market to the changes despite numerous current and potential challenges, such as inflation or disrupted supply chains.

Thus, the example shows that the market is generally prone to short-term alterations but is capable of recovery. The driver behind its swings is the overall economic and investor sentiment at a times when the rate is increased. Analyzing previous instances of such decisions demonstrates that while all sectors suffer from a short-lived downturn, additional effects are seen in industries more reliant on discretionary spending or those with high borrowing. Completely compatible sectors, on the other hand, such as financials, might even benefit from the rise of interest rates.

Higher Corporate Financing Costs

Interest rate hikes by the Federal Reserve tend to translate into higher corporate financing costs, and the impact is direct and significant. Business entities incur increased expenses and hence charges when they borrow money, and those that rely on debt for their day-to-day operations and growth are typically heavily affected by changes in interest rates. For example, we would expect the costs of borrowing to rise for real estate and utilities companies as they would seek to finance infrastructure and agreed-upon development activities. Some evidence to support this hypothesis is that during the tightening period in 2018, interest rate hikes meant that real estate investment trusts generally underperformed the broader market since they are highly interest rate sensitive. These operations in the industry, overall, often involve vast amounts of debt, and the cost of financing said debt is among the principal items on these companies’ balance statements.

Case Study: Manufacturing

Many companies in the manufacturing business take out loans and other financing to pay for the building of large-scale production facilities and machinery. I would expect that these companies would, therefore, be affected by the December 2016 rate hike as shown by new borrowing costs. I found that a leading organization in the automobile industry, one of the United States’ largest producers and sellers of cars, saw an increase in interest expenses by approximately 15% in the fiscal period following the hike. These costs contributed to a significant budget tightening and decreased the company’s period net profits.

Recent Trends

According to data from 2022, technology companies were similarly affected as the cost of debt increased when the Federal Reserve raised interest rates to combat inflation. Accordingly, many companies, especially startups and firms in the growth stage, which choose to finance this expansion using debt. The payback of this too became more expensive, leading to companies affected by the changes in interest rates cutting back on expenditures and changing their growth plans.

Enhanced Market Volatility

Interest rate hikes tend to enhance market volatility. Investors and financial markets usually respond to higher interest rates as a form of borrowing. The response is informed by future reduced economic activity due to the higher interest rates. Market volatility is often characterized by large and more frequent fluctuations in stock prices. Stock prices are more responsive to interest rates soon after their announcement, leading to significant stock prices adjustments.

Immediate impact

After an interest rate hike, stock prices immediately fall following the announcement. As a common example, in June 2021, the Dow Jones Industrial Average fell by over 500 points after the Federal Reserve hinted that it would consider raising rates sooner than expected . Stock prices had already reacted to the rates announcement well ahead of their implementation. Market participants are highly sensitive to any shifts in the bank rates, as they affect the yield on their investments and the forecast of the future economy in terms of investing.

Long-term Impact

Nevertheless, future responses may vary. The stock market may stabilize as companies and investors learn to continue doing business in a new capital worldview. For example, despite the 2015 adjustment in rates leading to a subsequent fall in the market indices, it took over a year for the S&P 500 to regain momentum .

Sector Impacts

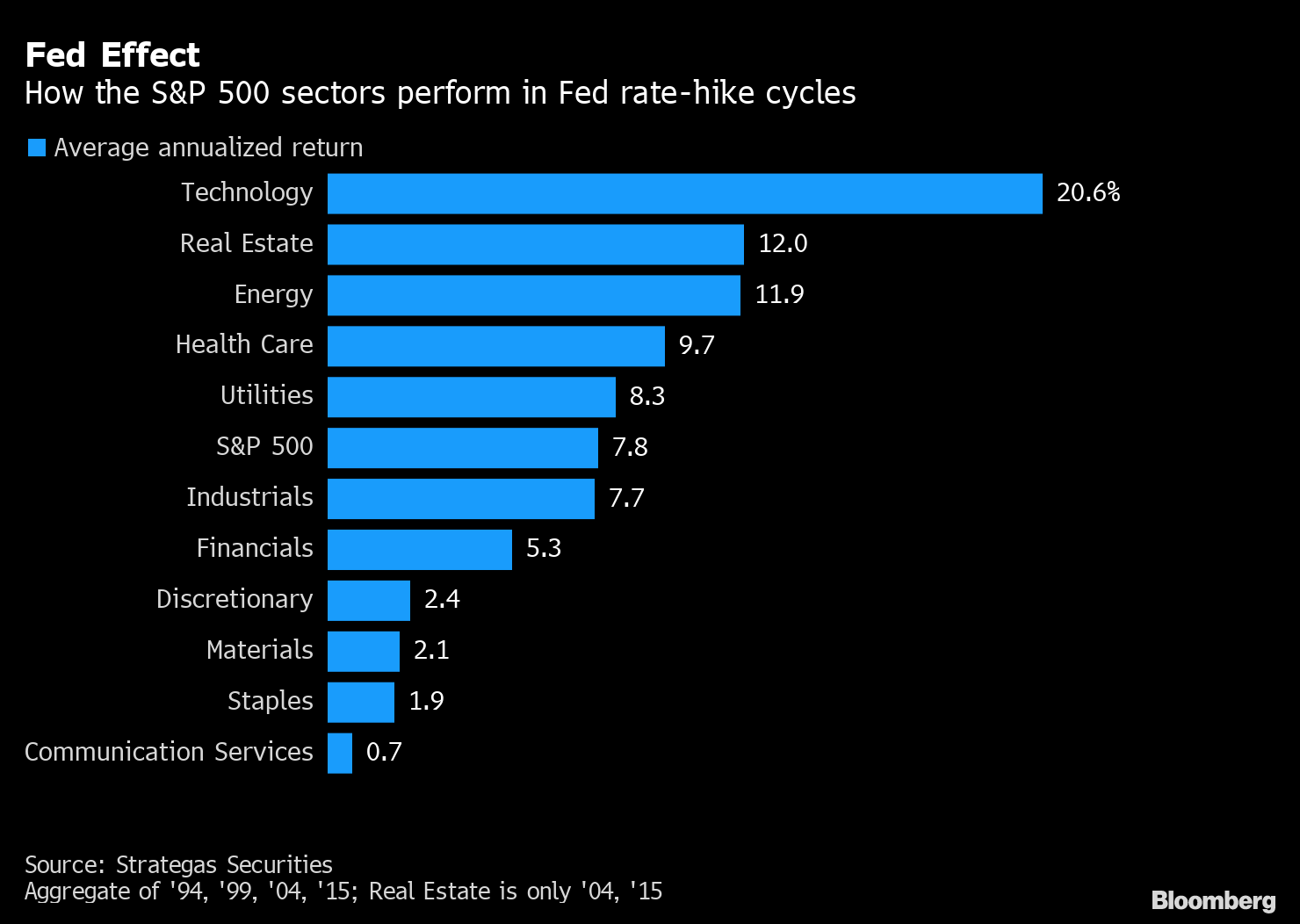

Sectors also have different responses to the rate hikes. The financial sector enjoys higher rates because of increasing margins in their loans and better interest on the loans. However, high-profit potential companies and other companies in the consumer market bore the biggest beating after the rate hike. They had initially applied a low rate mathematically to derive a high future cash flow and position its stocks in high valuations.

Adjusted Economic Growth Expectations

Apart from the direct impact of changes in interest rates on the provision of credit, Fed interest rate hikes also send signals to businesses, investors, and policymakers about the expectations of economic growth. Reactions to these adjustments in expectations are vital as they influence investment, consumer spending, and other economic planning.

Shifting Business Investment

Increasing the cost of borrowing money usually leads businesses to reassess their investments in capacity expansion. For example, the rate hikes in 2018 coincided with a noticeable slowdown in corporate capital expenditures . The planned levels of investments in equipment and machining were cut or postponed by companies in sectors particularly sensitive to changes in interest rates, such as manufacturing and construction. In addition, businesses deciding to go through with their investment plans are encouraged to seek alternative financing options to preserve the originally anticipated return.

Consumer Spending and Confidence

High-interest rates raise the borrowing costs of consumers in the forms of bigger mortgages, car loan installments, and credit card charges. Besides the impact on mortgaged companies, a reduction in consumer spending is one of the major risks influencing economic growth. IBCS Group’s 2017 consumer confidence indices data demonstrated that following the two rate hikes, indices registering a significant decrease, while retail sales growth stopped progressing at the same rate meriting a caution when assessing the fiscal demand side during such periods.

Revising Growth Forecasts

Economists and financial analysts frequently revise their growth indications according to the expectations regarding interest rates. For instance, following the series of rate hikes from the beginning of 2022, major financial institutions revised their GDP growth predictions for the U.S. economy downwards, reflecting concerns regarding reduced business and consumer spending.

Appreciation of the U.S. Dollar

Interest rate hikes by the U.S. Federal Reserve typically result in the appreciation of the U.S. dollar. This trend is associated with higher interest rates that offer greater returns on dollar-denominated assets. In return, the U.S. security market is expected to attract more foreign investment as it becomes relatively lucrative. As such, many analysts expect that the strengthening dollar would have implications for international investments.

Generally, when the U.S. dollar gains in strength, international investment towards this nation could decline. During the high rate hike of 2016, the U.S. dollar index appreciated considerably, courting reduced international investments in U.S. equities because U.S. stocks became more expensive for international investors. On the other hand, such strengthening of the U.S. dollar presents unique challenges for U.S. multinational corporations.

Notably, international organizations receive payment in foreign currency. Their earnings gains are, however, reduced when translated back to the U.S. dollar. Such an outcome implies that the dollar value of foreign currencies is significantly negligible. For instance, U.S.-based multinational organizations indicated that they made lower earnings in 2018 because the U.S. Federal Reserve raised interest rates on U.S. securities, which had a corresponding increase in the value of the U.S. dollar in the open market. Similarly, when the U.S. dollar is high or appreciates in value, exports by U.S.-based organizations become expensive, making them uncompetitive either in the domestic or international market. An apparent reduction in the demand for U.S.-based manufactured goods, especially after the 2015 rate hikes, highlights the impact on the manufacturing sector . Notably, such sectors as agriculture and automotive with a heavy reliance on the international market took a severe beating from the strong dollar.

Shifts in Cross-Border Capital Flows

The United States raises interest rates has massive influences on cross-border flows of capital. These flows affect investment patterns and therefore, exchange rates. Moreover, the changes are more significant because the same investments are made by people from countries affected by rate hikes.

Global Investment Portfolios

Under the high US interest rates, dollar-tied assets tend to earn higher returns, and this shift international monetary investments towards U.S. bonds and stocks. For example, during the corrective cycle that started in 2015, U.S. Treasury securities’ foreign investments rose. This influx not only strengthen the dollar but also creates an effect on other market’s liquidity.

Emerging Markets

These currencies are often punch-drunk by high rate hikes because, with rate rises, products become less risky. In addition, when rates are high, especially in the U.S. capital flows to more secure U.S. assets, leaving emerging countries in trouble. In 2018, rates highly affected Argentina and Turkey’s emerging economies, with the rates uncovered the existing problems in the countries’ current account deficits and leading to the devaluation of their currencies .

Uppsala University’s international ratings

This is how investments are reallocated, and since it is in terms of money, it affects exchange rates. For instance, a strong dollar is often associated with poor exports because most goods are priced in terms of the greenback. Weak sales attract intervention in rates and flooding the market by central banks around the world. The readjustments are vital in the world’s economy because it creates stability.