Dominant Market Share

One of the primary factors that make Coca- Cola appealing as an investment is the level of control of the global beverage market that the company has achieved. It is apparent that such a result would be impossible if the company was unable to create enough demand for its product to be able to provide it with a commanding share of the market. Thus, the ability to control the global market for beverages demonstrates that Coca- Cola has strategic superiority and essential brand value. According to Statista , Coca-Cola’s share of the carbonated soft drinks market is nearly 44 percent, which is an excellent illustration of its market dominance. Evidently, controlling almost ½ of the market for one of the most competitive goods in the world would generate substantial revenue, and yet the more important conclusion is that it insulates the company from market pressures: with such a commanding share, Coca- Cola can be sure that no other company can have enough control to displace it from its top position.

Considering market share stability

Market share stability is one of the factors that interest investors, as it is a key to profitability. In this light, it is crucial to note that even though there have been numerous would-be-disruptors in the beverage industry, Coca- Cola has managed to maintain its strong position and even grow it, expanding from soda to beverages such as water, juice, and energy drinks. Coca- Cola’s acquisition policy, for instance, demonstrates that its strategic acquisitions of alternative beverage companies have an excellent track record of sustained market share. Thus, investors can be relatively certain that the market share will be stable. It also has to be noted that a significant reason why the market share has been stable is that Coca- Cola leverages acquisitions to expand its customer base and geographic reach while increasing effectiveness and gaining synergies from the consolidation.

Current Performance and Potential

Coca-Cola has been gaining a higher market performance and has been doing well since. Whether one should buy, sell or hold the stock is a valid question that can be answered by examining the most recent earnings, market strategies, and industry trends. This paper draws on both the recent financial outcomes and the market strategy of Coca-Cola to provide an informed investment decision.

First, regarding recent financial outcomes, Coca-Cola recently reported a 6% increase in revenues year-over-year for the latest fiscal quarter. The net revenue was reported to be over $10 billion during the mid-2019 periods. This higher revenue levels are largely attributed to the increased demand in Coca-cola in some varied places around the world and the higher marketing financing in such a manner that demand is high for Coca-cola drinks. The firm effectively manages to continue to generate high cash flows over time. The most recent reported operating cash flows were reported to be about $9.1 billion for the whole of 2019. The company performance is higher than that of the peers and, therefore, dominates the age of the markets by a high margin.

It is important to note that the company has demonstrated efficiency above industry levels, and therefore, a better position within a changing consumer demands and market dispositions. Second, Coca-cola drinks are also venturing too much in trying to promote healthier drinks, such as plants-based drinks, teas, and juices at the same time. This is an attempt to capture a higher market in the current world, with all people running in the name of staying healthier. The company is better relying on innovation and marketing. Third, the company is already investing in the digital transformation and energy to capitalize on the internet sales for a huge market with these resources. The company operations are also already featured on the internet. Notably, the most recent investment plan is letting the company shifts in these operational investments. The message is a ‘buy’ for investors. However, some are already making huge profits and should reduce their investments.

Recent Revenue Growth Trends

Revenue growth trends of Coca-Cola is a potent representation of the company’s economic performance and future opportunities. By closely examining the company’s quarterly and annual financial reports, one can obtain comprehensive insights into Coke’s performance and future strategies.

Quarterly Revenue Growth

In the last quarter, the company’s revenue increased by 6% as compared with the same stage of the previous year . The sales amounted to $10 billion with the increased volume of goods and bucket of fixed prices . One can claim that this achievement is impressive, given the global economy’s fluctuations and increased competitive pressure in the beverage sector. Revenue growth is attributed to rising sales momentum and ever-increasing consumer demand for the company’s product assortment. The company’s management is doing the job right with respect to the price increase demand tactics.

Year-On-Year Performance

Together with revenue growth momentum, Coke has been consistently enhancing revenue amounts due to the massive expansion of its product assortment and market development. In recent fiscal years, the company successfully broadened its market reach across the world in the development of the rapidly growing markets in Asia and Africa. It implies that the company is able to follow global consumer trends, such as the increased consumption of healthy drinks, such as water or tea. The company launches new low-calorie products and non-carb drinks and meaningfully expands its market geography. In conclusion, the revenue growth trend of Coca-Cola is of critical importance for investors. Given ever-increasing sales and trends in strategic investments and market expansion, the company remains a sustainable long-term investment. Thus, such investors should buy more stocks or hold their shareholdings.

Expectations for Year-Over-Year Organic Revenue Growth

When the investors want to assess Coca-Cola’s prospects, they should consider the projected organic revenue growth year-over-year . Most analysts thought that the OGR was defined by the money earned by a company from core operations while excluding acquisitions, divestitures, and the effects of foreign exchange. Correspondingly, the OGR might be seen as an essential indicator of a company’s growth pace and the potential for earnings.

Projected Organic Growth Rates

Notably, Coca-Cola’s management projected a seven percent OGR for the current fiscal year . This is associated with the company’s continuous product innovations, increased market saturation, and pricing that could compensate for the growing production and development costs . In the case of Coca-Cola, this growth might be assessed as somewhat surprising as it operates in mature markets. In addition, the situation in the world is also difficult for such aggressive growth.

Factors That Will Drive Growth in the Future

Several critical factors will shape Coca-Cola’s OGR. First, the company’s expansion into growing beverage segments like healthy teas, sports drinks, and plant-based beverages creates its revenues. Second, the growing focus on digital tools and online sales might also be beneficial in terms of direct consumer contacts and better sales creation. On balance, it is expected that the market investments in the high-growth regions such as Asia and Central and Latin America will soon pay off. Notably, the growth of the middle class and economic conditions in these regions indicate that demand is strong.

Strategic Implications for Investors

The investors might benefit from the consideration of the above points for decision-making. With the relatively high OGR, the risk of substantial losses attributable solely to the impact of external factors is relatively low.abilisation.

For the long-term perspective, those investment community members who are interested in the stable returns might consider buying the stock. At the same time, the individuals willing to see rapid growth and get high returns might not be interested in the relatively moderate OGR in the stable, although slow, an industry where money provides a good additional value for the companies but not a product like fancy products, drinks, or luxury goods.

Consistent and Secure Dividend Payouts

A reliable and consistent dividend policy is one of the primary reasons for investors to buy or hold Coca-cola stock. The fact that its dividend history and policy reflect the company’s financial stability and dividend ensures its attractiveness for many investors.

Dividend History

First of all, Coca-cola is a member of the exclusive club of the Dividend aristocrats by having a 59-year streak of increasing its dividends . Second, it offers astonishingly high current dividend yield of approximately 3.1%. The average yield of the S&P 500 is less than 2%, so Coca-cola’s yield is one of the best among the blue-chip stocks. In addition, it reflects a rare feature of lifting its dividend yield without a miss. Specifically, its dividend payouts have been rising every year, and this trend of increasing the return on investment shareholders reward the company’s high operational efficiency with robust cash flows. Declaring dividends on a regular basis and raising it reflect that cash flow from operating activities in six of the last 12 years grew by more than 7 billion dollars.

Analysis of the sustainability of the dividend

Coca-cola’s dividends are sustainable already for several reasons. First, even last year, its free cash flow has been growing and amounted to $9.1 billion . Dividends paid out in 2020 have also been the biggest for the past five years and reached approximately 7 billion dollars . Therefore, considering that net income dropped by less than half last year, it can be concluded that its dividend-to-income ratio is also sustainable, amounting to a bit less than 77%. Therefore, if the company were to maintain such profitability and free cash flows, it could not only keep its dividends sustainable but also continue to increase it in the future. Many investors are interested in such information because for many prospective investors of this company, dividends will be the most important part of their investment strategies.

Buy, Hold, or Sell

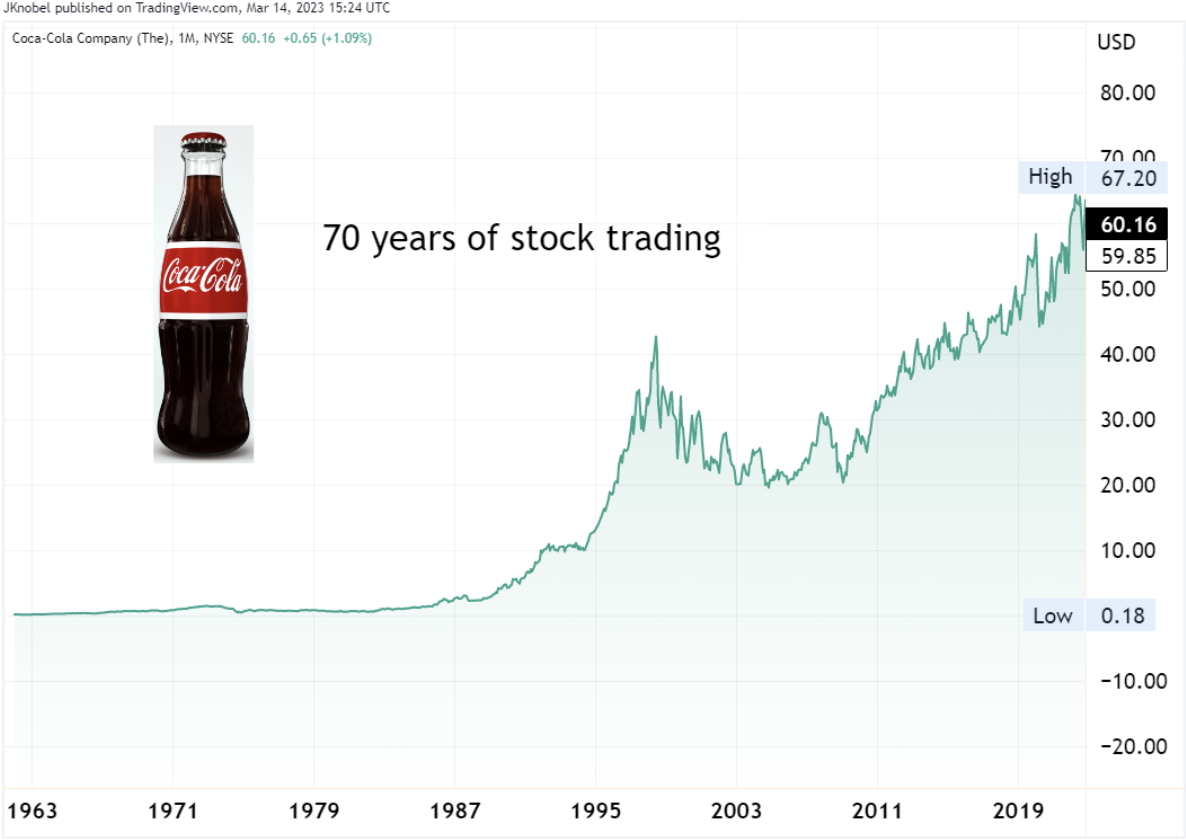

Deciding on whether to buy, hold, or sell Coca-Cola stock requires analyzing its historical price data, market performance, and current valuation ratios. To elaborate on the detail of price points and strategies, the more profound analysis of Coca-Cola’s past and present financial indicators is required.

Criteria for Buying

Investors may buy the Coca-Cola stock once it gets closer to a key support level which is typically revealed during market declines. Historically, the Coca-Cola’s stock was strongly supported at the level of approximately $50 per share, which was the price point tested during such market downturns as early 2020 . Therefore, if the Coca-Cola stock decreases and reaches lower than $50, it could be the opportunity to buy since the company’s fundamentals are strong and the dividend yield is stable. The purchase below or at $50 will benefit from the possible upward trend following the market correction, supported by the company’s resilience and ongoing expansion beyond the saturated US market.

Criteria for Holding

Coca-Cola stock should be held if the investor already decided to buy the shares at a higher price and aimed at long-term growth and collected dividends. For instance, purchasing the stock at around $55 is close to the average price of Coca-Cola stock over the past few years; therefore holding is the best decision to obtain the dividend yield that significantly supports the total returns. Thus, the stock price between $55 and $60 should be held since it is common for Coca-Cola to perform at the given market range and no significant acceleration of growth is expected.

Criteria for Selling

The Coca-Cola stock should be sold if the stock grows significantly higher than historical maximums and the market valuation indicates the possible overpricing. For example, if the stock reaches higher than $65, it could be a sign to sell since the stock was rarely sustained at the given price point without overvaluation. This decision is especially relevant if the market shows the possibility of topping, while the existing macroeconomic indicators explain the probability of decline. Following Coca-Cola’s stock growth above $65 should activate sale since its price will not increase much further at a reasonable risk level, especially considering the period of accelerated growth for the whole economy.