Overview of Global Market Hours

Understanding the global market hours is vital for a trader or investor who performs financial operations on an international level. Those markets include stock exchanges, the commodity market, and the foreign exchange market, and each has its operating hours. Being able to trade almost 24 hours a day is excellent for those who seek to benefit from the opportunities that international markets provide and exploit the ones that appear outside a local exchange’s operational hours.

Major Financial Markets and Their Trading Hours

The global markets in question are as follows:

New York Stock Exchange: Located in the United States, operates from 9:30 to 16:00.

NASDAQ: Also in the United States, with the same trading hours.

London Stock Exchange: The United Kingdom, 8:00 to 16:30.

Euronext: France, Belgium, the Netherlands, Ireland, and Portugal. 9:00 to 17:30.

Tokyo Stock Exchange: Japan, 9:00 to 15:00.

Shanghai Stock Exchange: China, 9:30 to 15:00.

Hong Kong Stock Exchange: 9:30 to 16:00.

Understanding the Market Hours

The overlaps of market hours between different regions provide a trader with high liquidity and therefore more opportunities. For example, the London market operates from 3:00 to 11:00 EST, while the New York exchange starts at 8:00 EST and closes at 16:00 EST. This means that the period between 8:00 and 12:00 EST is the time of increased trading activity. It is crucial for every trader to understand these periods and how they relate to their operational hours.

Time zones play a large role in global trading. Depending on the market, the trader must adjust their strategy due to these zones. An example of this would be the case of an Asian trader. To access the European and, subsequently, the American markets, the Asian trader has to engage in trading at an unconventional hour. This led to market time zones dependent trading. Starting in 1980s, know-how and information played a major role in trading as the hedge funds had a vital start with the stock market arbitrage as their own effort. Hedge funds became successful over the years due to their active trading with the help of new technologies. With the information known to some people, they made disproportionate profits as they outperformed other traders in the financial markets with the available information through insider trading. The edge made by these traders was legal as there were no security laws/police that would prevent this edge. Furthermore, all trades were conducted in the same market and at the same time. After this era in the late 1990s and the 2000s, hedge funds went onto pursue the faster and more innovative trading routes that allowed them to outperform the mutual funds but these ways influenced volatility and instability of the markets.

With the move towards the markets themselves as a measure of the performance, skilled managers sought to buy the managers at a low price and sell them for a greater price to gain profits. This was triggered by merger and acquisition announcements. Later on, they spread stock. All these strategies were undervalued and gave a discrete profit base to the skilled managers. Doing that the brokers made profits on the spread between asks and bids of the newly bought stock. Thus, time zones affect trading in general since the activities done in some zones are based on the prevailing conditions of that specific time.

Interest Rate Risk

Generally, as securities’ maturity increases, so does the interest rate risk. This means you should have opted for bonds with the same maturity rather than different maturities.

Remember that callable bonds have higher reinvestment risk. They are considered riskier by investors because interest rates may decrease, forcing you to reinvest at the lower rate or force you to sell the bond at a point when other investments’ rates are equally low, if not lower.

Also note that deficits tend to reduce the refinancing risk – less available capital and generally higher rates mean that the issuer is unlikely to call the bond over refinance. In that case, you will be stuck with the lower yields than offered by your original bond and without more profitable refinancing options.

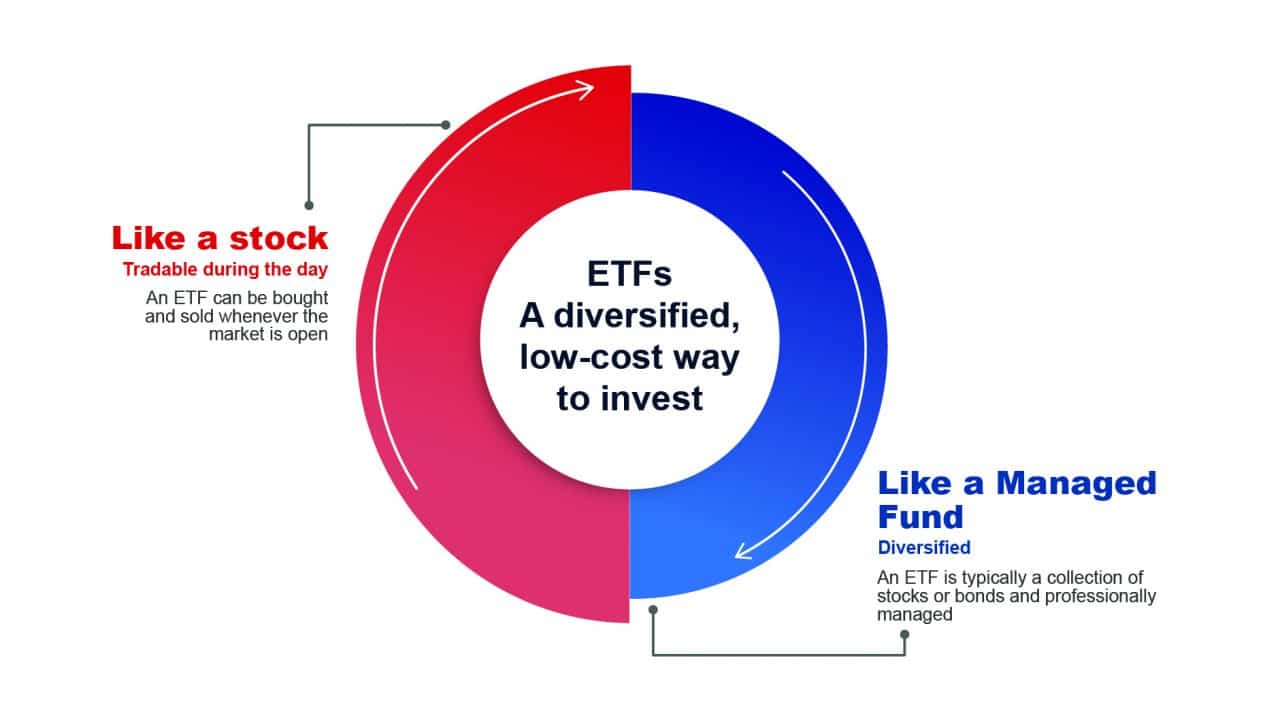

Arbitrage Opportunity

Time zones can offer arbitrage opportunities for traders. To remind, arbitrage refers to buying an asset in one place and simultaneously selling it in another, where the price is higher. If ETFs are traded both on NYSE and, say, the London Stock Exchange, a trader may earn on buying the asset as it is cheaper on one of these markets.

In case you are an international investor, you should remember that ETFs are traded at different times in different time zones. You should adjust your trading schedule according to the hours of these markets or you can lose part of the profit due to exchange rates if you prefer trading the same ETF across different time zones.

Economic Data Releases

Economic data releases, such as employment reports, inflation data, and central bank announcements, can cause significant market volatility. These events are usually scheduled in advance, allowing traders to plan their activities around them. By avoiding trading immediately before and after these releases, investors can reduce their exposure to unpredictable market movements.

End of Day Volatility

Similar to the market open, the market’s closing hour usually leads to increased volatility. Traders liquidating their positions and executing varied end-of-day orders can drive bigger market movements. It is advisable to start trading long before the final hour of the day to avoid risk.

Strategies to Avoid Volatility

- Use Limit Orders: With limit orders, traders can execute trades at the required price or better, managing potential losses during volatile times.

- Utilize Stop-Loss Orders: This gives traders the ability to control losses by determining the price at which a stock should be sold off automatically.

- Use Volatility Indexes: Indexes such as the VIX can be used to determine when the market is more volatile and help traders plan.

Advantages of Trading Towards the Market Close

As such, the market close, usually considered the last hour of the trading session, has several strategic advantages. There is usually increased liquidity, relatively more compounded predictable price movements, and the chance to respond to the latest news as it comes.

One of the reasons why you would want to trade towards the market close is because of the increased liquidity of trades. In the last hour of the market’s operation, stock volume is often greater because traders as well as institution investors want to adjust their positions accordingly before the end of the day. When more trades are conducted, the bid-ask spreads of stock shrink. This provides the investor with the benefit of easily selling or buying large lots of stock without affecting the price significantly. Another reason is provided by the stability of prices, which is assured in the final hours of the market’s operation. It is natural for the security price to experience many fluctuations when the market is first opened. However, these fluctuations settle down towards the end of the trading day when the majority of the information necessary for market analysis is given and the news regarding the product is absorbed. In the final hours of operation, it also becomes easier to execute trades by reacting to relevant news that is provided only a few hours before the market is closed. Returning to the example provided in the previous module, the news about Boeing’s delivery delay was only received after the normal hours of operation.

In essence, when the market reaches its closing time, the majority of stock and security exchanges hold an auction that is meant to dictate the price at which stocks are closed for the day. This process is referred to as the closing auction of the market operation, which provides extraordinary benefits when trading. As the investors manage to buy the stocks at the closing price – which often stands as the determinant of the future position of the stock. They can continue trading in inverse relation to receive the best outcome. When trying to achieve high results in trading in the final hours, investors must consider the following strategies. First, they must monitor the overall market trend during the day to make an informed decision about what will positively affect their position. Second, the use of limit orders, which reflects the point at which the investor is selling at the price above, should be considered. This will provide the trade execution guarantee, ensuring that the trade only occurs when the stock gets back to an ascending position. Third, the investor must consider reading the news and other late reports to make informed trading decisions.

Bid-Ask Spreads and Their Importance

The bid-ask spread is a key concept in any financial market, representing the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to offer. As such, bid-ask spreads are a vital concept for traders and investors because it directly affects the cost of trading and the liquidity of assets. In this paper, I will review the reasons behind changes in bid-ask spreads and analyze its importance for traders. The main determinants of the spread are:

- liquidity, with highly liquid currencies or, for example, large-cap stocks having the narrowest spreads because tighter price competition happens when more buyers and sellers are available;

- volatility and the additional risk market makers have to take due to frequent fluctuations of prices;

- market conditions when normally liquid currencies or stocks can experience a substantial increase of the spread due to higher demand because of, for example, economic announcements or geopolitical events taking place.

Importance of the Bid-Ask Spread for Traders

Firstly, the spread is significant because it is a vital part of the purchase cost. A trader will never be able to sell at the same price they have bought an asset for, and the latter has to overcome this difference before generating a profit. The second reason why the spread is crucial for the people in the market is that a spread that is too wide will mean that an order is unlikely to be executed at a desirable price, and there may be slippage when the executed price of an order will not be equal to or immediately after the spread but could widen. Finally, the bid-ask spread is an important concept because unexpected changes in spreads may be indicative of changes in market sentiment or, for example, liquidity. One way to mitigate the impact of bid-ask spreads is to utilize limit orders, whereby a trader can specify the price at which they are willing to take an action.

- Peak hours: attempting to perform this activity during hours when the market is the most active can contribute to narrower spreads due to higher liquidity.

- Asset selection: choosing liquid assets can aid in the minimization of the other form of cost associated with the bid-ask spread.

How to Mitigate Risks During Flash Crashes and Extreme Volatility

Flash crashes and times of extreme volatility are issues that present a range of risks for traders, who must plan and act with this in mind in order to effectively mitigate the associated risks. Proper risk mitigation requires a range of advanced risk management techniques, including those presented below.

Understanding Flash Crashes

A flash crash is a sudden, sharp, and usually short, price drop for a specific asset or group of assets. They may result from a combination of factors, such as market sentiment changes, the nature of the market at the time the flash crash occurs, and a sharp decline in liquidity.

Risk management strategies

- Stop-loss orders

- Position sizing

- Diversification

Handling Extreme Volatility

- Avoid overleveraging

- Stay informed

- Use volatility indexes

Emotional control is essential, and all market activity must be conducted calmly and systematically.