Identifying Bullish and Bearish Flags

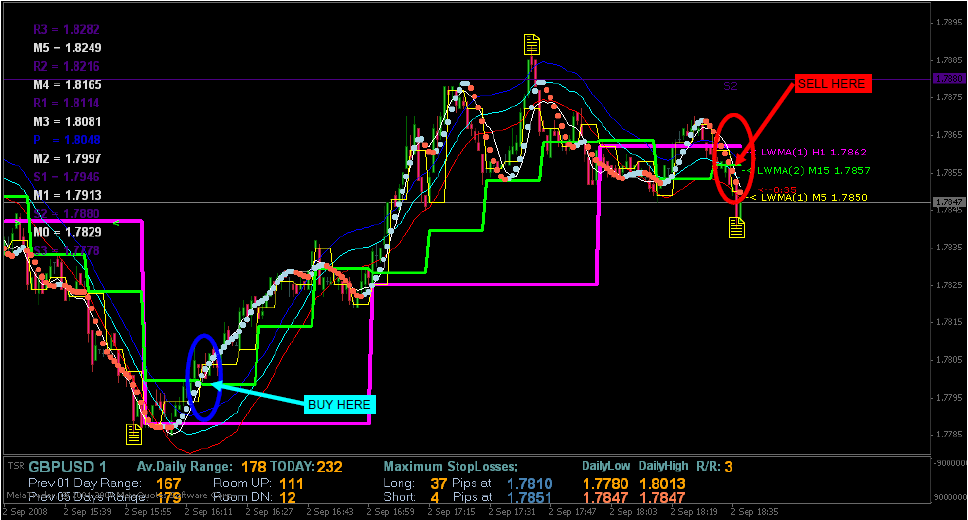

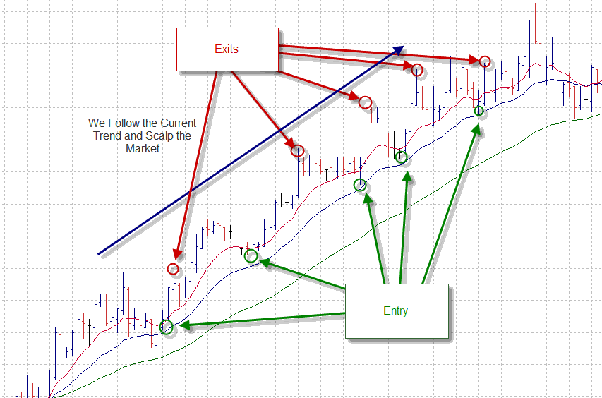

When you partake in the high-stakes game called 1-minute scalping, finding and exploiting bullish and bearish flags can define the trajectory of your venture, determining whether you win or lose. The flags in question a chart pattern that signal either a continuation of the previous trend or a reversal of said trend, which is a critical piece of information that can inform your decision. If a new trend is to start, they are often the first step in noticing and recognizing it. They can be used to help spot declines or increases and give you the tools required to have child’s play with the current situation.

Bullish flag. One of these patterns that signal a bullish reversal is a so-called bullish flag, which happens when the already-established upward trend is halted. The consolidation formation that appears under such conditions can be compared to a flag drawing closer to the flagpole, as if it were driven by the wind. This pattern implies that an upward momentum is taking a break or a breather and will soon continue. For example, if the stock has been moving steadily upward, and then, when entering lower volatility, a flag starts appearing at its flagpole formation, the implication would be that the price is about to rise again.

Bearish flag. On a similar note, a bearish flag is formed when the downtrend is interrupted, meaning that the selling pressure will stop before continuing further in the same direction. It can be seen the same way as a bullish flag, only opposite: namely, as if the wind blew the flag down. An example would be if a stock is dropping and then stops and starts consolidating – if it happens while a flag shape emerges, it means there will be an even sharper decline.

Pattern parameterization. To simplify the quantitative detection of this pattern, some rules can be applied – for example, a bullish flagpole will always be a steep price increase that should be no less than 10%, and the flag itself should be a smaller symmetrical triangle indicating a future increase of value by the same distance that the flagpole’s value was increased by. The bearish flagpole will be a steep decline, and the flag will be a tiny inverse triangle, once again indicating a similar drop.

Method. Upon identifying a flag pattern, a trader will have to enter a trade and put in order a few subsequent trades. For a bullish majority, the parament will be the breakout of the upper trendline, while for bearish majority orders should be put in upon the breakout of the lower trendline. The stop-loss should be put at a value lower at higher altitude than the à support line

Risk management. In order to minimize risks, the stop-loss order should be placed a small distance, often just a few pips, from the entry rate. The profit target is the length measured from the support line to the breakout point. Let’s take an example of a bullish flag with a 15 pip long flagpole on EUR/USD pair spotted during London session. The breakout point is located at 1.1855 with a stop order at 1.1853 . In that case, the take profit order should be located at 1.1870.

Using Technical Indicators

When it comes to the high-speed play of 1-minute scalping, technical indicators are your trump card. They give you the types of data that you need in order to make qualified decisions with both precision and speed. Stochastic Oscillator : A favourite in the arsenal of most scalpers, the stochastic oscillator lets you measure the momentum of price movement. It is especially sensitive to short-term market fluctuations, which makes it perfect for 1-minute charts. Per se, a reading above 80 indicates overbought conditions and that the price is ready to make a U-turn anytime soon. Whereas, a reading below 20 indicates oversold conditions, pointing at a potential bounce of the price. Spearheaded Approach : In a bid to quantify this approach, set your indicator to the default 14-period setting. A common strategy is to sell when the %K line crosses below the %D line and buy when it crosses above. In other words, if you are wallowing in dashing around the GBP/USD pair, enter a long position when the stochastic oscillator is showing a cross above. Set your stop at 2 pips below your entrance and set your limit at 3 pips. Volume Weight Average Price ? your other powerful weapon. It offers a dynamic level of support and resistance on any given trading day. If the price is trading above the VWAP, it is generally considered to be an uptrend, and vice versa.

With a data-driven strategy, you will observe the price action relative to the line of volume-weighted average price . Suppose the price line crosses over above VWAP – this may signal for you to enter a position. Your target can be set at the price level corresponding to the average daily range of the instrument. For example, in the volatile market of Dow Jones futures, a 5-bar move above VWAP could be a good entry indicator with a 10-bar target and a 3-bar stop-loss.

The moving averages are vital for scalping – they smooth out the price data and help to discern the market trends. The simple moving average is calculated as the sum of prices divided by the number of periods. The exponential moving average puts greater emphasis on the most recent price changes, which makes it the go-to choice for your 1-minute chart.

To illustrate, suppose you are trading NASDAQ 100 index futures and using the 1-minute chart. You put a 3-bar EMA on the next chart and use it to evaluate the short-range tendency. If the current market price is above EMA, this should be your cue to go long. Your tactical exit can be when the price goes to the level halfway from the daily average true range . Your stop-loss can be put at the EMA. In scalping, the risk-reward ratio is paramount. With target profits being limited, you should be certain that the risk is worth it. A widely employed identification is 2:1, which would imply that you get at least 2 pips for every furrow you risk.

Let’s take an example scenario. Imagine you are scalping EUR/USD, and you realize the stochastic oscillator has just crossed above 20, indicating the possibility of a bounce from oversold levels. You establish a long position, specify the profit target at a price level by 5 pips above your entry, and set the stop-loss 2 pips below. This way, you have a risk-to-reward ratio and know exactly what you would do in advance.

Identifying Key Support and Resistance Levels

In the high-speed world of 1-minute scalping, competitive support and resistance levels are crucial. Support and resistance act as achievable price boundaries in or out of which a currency pair price should and should not go. Determining support and resistance levels is based on and, done with prior price data. Identifying and accurately using these levels is therefore a composite of both historical knowledge and the ability to make what are often immediate decision trades. The first requirement for selecting an area of value in scalping is highly refined execution, while the second is the ability to make trading decisions, which can only be done with an understanding of the indications of support and resistance. Support is the potential buying area where price finds it difficult to fall below whereas resistance is the potential selling area where price finds it difficult to breach for an upward move .

Quantitative Recognition

In order to identify these price levels, traders look at areas where price has reversed at in the past. For example, if the price of a stock has bounced back three times from $50, the resistance level at $50 is likely to be strong.

Data Approach

A common procedure is the use of the highest candlestick on the one-minute chart, the lowest candlestick, the candlestick of the previous closing, and the candlestick of the opening. In one minute, when price levels change consecutively, actively traded securities will often have the volume listed for each price level, which also indicates and corresponds to a price level.

Tactical Example

Consider that we are on a scalping mission on the S&P 500 mini futures. Properly analyzing the past hour’s prices, you note that the price refuses to move below 2,920 and any dip is pushed back by a bounce; 2,920 is, therefore, recognized as a strong support level. Conversely, the price is rejected at 2,930.

Implementation

Set up your trades using the support and resistance levels previously identified and analysis. A trader determined to go long in the currency pair should do so at 2.920. His stop-loss should be less, for example at 2,919. His take profit should be at, 930. The take profit aspect will automatically get him out of any traffic jam at the upper discounted region. Therefore, the risk-reward ratio for a pair is 1:1. However, since as a scalper, the minimum RR is 1:2, the take profit level for a buy should be moved to 2,921.

Dynamic Strategy

Remember that other players are also continuously updating their data, making it necessary to constantly update your own calculations. Suppose you are going to scalping on the EUR/USD, during what should be the best hours of London. The key destination you have market and should aim is 1.1200. This level has no less than trey reaction mornings in and a support march. \buys at 1,200. We were protected by stop-loss capital at 1.1195. We would like to get around 1.1210, as well. A better R/R ratio.

Using Tight Stop-Losses

In 1-minute scalping, creating tight stop-losses is the fundamental tactic to manage risk and safeguard your capital. Here is how you might execute this vital aspect of trading with accuracy and certainty.

Definition of tight stop-losses: They are defined as orders which are placed below the entry price in a long position and above in the short position, aiming at keeping down potential losses. While scalping, it is necessary to maintain the stop-loss level as low as possible without being bumped out as a result of market noise.

Setting stop-loss levels: A trader is to consider a volatility of ticks that is characteristic of a given tool. If the average true range is 5 ticks per 1-minute tick on a chart, then the stop-losses described ought to be set at 1 to 3 ticks below the long position entry for the future.

Data example: For instance, you are scalping the GBP/USD pair. Taking a long position at 1.3000, you happen to find the 1-minute average true range of 10 pips, for example. Stopping the loss at 1.2995, that is 5 pips below the entry point, is equal to a half of the ATR and is in line with the definition of tight stop losses.

Risk-reward balance: Tight stop is usually combined with a corresponding tight take-profit deal to reach a risk-reward ration of 1:1. In the above case, the target price of taking a profit would be 1.3010 or higher.

Adjusting to market conditions: The trader may shift his or her strict stop loss level. If the forthcoming information decreases volatility, the trader might be instructed to augment the level of his stop loss in order not to be knocked out of the given trade before the stipulated time.

Trade Execution Example: You are trading the DOW futures and it seems that you have identified decent support at 33,500. Then, the long at this level would be the right option. The takes profit place: 33,510 . At the same time, stop loss is placed at 33,495.

High Liquidity and Low Spreads

When it comes to 1-minute scalping, nothing matters more than the liquidity of a market and the tightness of its spreads. Here’s how to ensure that these 2 conditions work for rather than against you.

Liquidity in a Nutshell: The more liquid a market is, the more buyers and sellers there are. You can jump in and out of the price action however you want. In scalping, where every minute or even second counts, this advantage is important.

Liquid Markets: Major currency pairs like EUR/USD, USD/JPY, or GBP/USD are naturally more liquid. You can also check the trading volume of a specific asset in order to determine its liquidity. For example, a stock with a trading volume of more than a million shares is considered liquid.

Understand Spreads: This parameter reflects the difference between the buy and sell price no matter what asset you trade – stock, forex, or something else. Scalpers aim to make a tiny profit on every deal, so almost every little thing counts here.

Measures: Look for the tightest spreads you can find. In very liquid markets, they will resemble using decimal points: somewhere around 0.5 – 1 pip for major currency pairs. For your strategy, preferably take your skepticism and gingerly hide it under a rock.

Have a Scenario: Imagine that you scalped the EUR/USD for the European session. By any trading session, London is definitely the most liquid. The spread will most likely be around 0.7 pips. Does that make scalping feasible? Yes, it does.

Trade Data: Scenarios suggest you see a technical signal and it’s a buying one. Your current bid price is 1.1200 and the ask price is 1.12007. You enter the market buying for at the price of 1.12007. Your profit goal for this position is 1.12017 — you buy and then immediately sell EUR/USD, managing to get a 10 pip gain. The 7 pips above the market price cover the spread, giving you a 3 pip gain.

Realize the Market: Keep in mind that the offered spread might not always hold. It becomes more of a rule rather than an exception during less liquid hours or more volatile market conditions. Make a plan for these situations or just stop. And also, make sure to pick a seriously liquid broker. Some get away with tight spreads only during regular trading hours and triple or even quadruple them on weekends or after hours or use variable spreads in the best case. Make sure you’re aware of their policies.

Managing Risk and Reward

Scalping is a high-speed trading method where a trader must have pinpoint accuracy and discipline, especially when it comes to the risk-reward part. But how do you get it right?

Risk Management Fundamentals: In scalping, we aim to achieve many small wins rather than trying to make a few big wins. Therefore, you need to manage the risk very meticulously. Your gain potential must always surpass the risk.

Set a Tight Stop-Loss: A tight stop-loss is your first defense. For example, consider that you are trading a stock with one-minute chart analysis, and the average volatilities are 5 cents. You may set your stop-loss at 2 cents below the entry point to keep the risk minimal.

Calculate the Profit Target: The target should also be calculated with similar precision. Still considering the same stock, say your stop-loss is 2 cents. For a 2:1 risk-reward ratio, you calculate 2×2=4 cents. Therefore, you expect to make 4 cents and close the trade before the stock loses the gain.

Scalping Example with Data: Let us consider an example to make this clear. You are scalping the EUR/USD forex pair. You buy at the base rate of 1.1000 and set 1.0995 as the stop-loss, so your stop-loss is 5 pips. The take-profit level is 1.1005; the profit target for you is 10 pips. Hence the risk-reward gives 5 pips versus 10 pips.

Dynamic Risk Management: The above parameters are not constant, and you will have to change them according to the field conditions. If the market is more volatile, you may need to tighten the stop-loss and reduce the profit target to maintain the risk-reward ratio.

The Power of Compounding: Even if you have a 1:1 risk-reward ratio, if you make several tens of trades per day, the compounding will do the trick. Let us consider an S&P 500 mini futures trade example. You are trading during the US session and buy the position at 3,000 and set the stop-loss at 3,997. You expect to make five points with a profit level of 3,005. The risk and profit targets are 3 points and 5 points, respectively.

Concentration and Quick Decision Making

1-minute scalping is a high-octane form of trading in which the ability to concentrate and make quick decisions is just as important as the technical strategies. Here’s how to master these skills.

Focus on what matters: Since scalping is a short-term strategy, there is a high number of trades in every session. Remaining focused is essential when you are under pressure.

Quantify your concentration: the easiest way to train this ability is by specifying the number of trades. For example, do not make more than 10 trades in one session. When increasing this number, you will start feeling fatigued and switch into low concentration mode, which is inefficient.

Decide quickly: 1-minute scalping requires you to make quick decisions since you have to adapt to market conditions on the go. That means that you should be able to analyze the situation and make a decision in a snap of a finger.

Example with data: let’s say that you are scalping the GBP/USD. You see that the volume on the previous 1-minute candle was tremendous, so the new one opens with a gap and tries to break a level. It takes two or three seconds of looking at the screen to see the situation, decide to go long, and execute the order. It is incredibly important because in the forex market, this is the speed at which this asset moves.

How to train quick decision making: the only way to achieve that is by practicing. You can add positions at a demo account, simulating similar market conditions, and try making quick decisions.

Do not overtrade: when making this analysis, traders often feel confident in their abilities and engage in overtrading. It is a dangerous state, as it simply forces a trader to make decisions quicker. Set a limit of trades for every session and take breaks.

You have an opinion about the market movements, you see a pattern on the 1-minute DOW futures chart. In the most crucial second, you decided to go long at 33,500 and set a stop-loss at 33,490 and a take-profit order at 33,510.

Non-Attachment to Specific Time Zones or Stocks

Not being tied to a specific time zone or stocks, scalpers have an advantage in terms of flexibility. Let me show you how to benefit from this key characteristic of scalping.

Global Market Access

Scalping can be done around the clock, as long as there is a liquid market open somewhere in the world. Therefore, no need to stick to one particular time zone. For example, having scalped the US equities market in the morning, you can jump to the forex market, which is now experiencing significant liquidity due to the US-EU overlap .

Making the Most of Fresh Markets

Moreover, fresh markets imply fresh movement. There is a notable difference in trading styles in Asia, Europe, and the Americas, therefore, you might want to utilize the vast variety of opportunities available.

Proper Stock Selection

There is no need to have your favourite stocks to scalp. Scalpers need liquidity and volatility with famous companies being good examples during US hours. However, stock activity tends to subside from time to time. Therefore you can shift your attention to highly traded commodities or forex pairs.

Metrics for Stock Selection

Based on some metrics, you can easily identify actual or liquid stocks. A daily volume of over a million shares is substantial, as well as an Average True Range each day of at least 2%. Let me provide you with an illustrative example in terms of flexibility:

Imagine you have caught a good scalp on the NASDAQ during morning US hours. As the activity in the US market subsides, you switch to the forex markets, as the US-EU overlap kicks off, with Asia’s executions still in the market.

Your strategy needs to be as flexible as the markets in which you execute trades. For example, if EUR/USD is not too volatile, you might want to turn to commodities, for example, oil futures, which jumps up and down considerably. You also need quantitative metrics when making decisions. Consequently, when RSI indicates a stock is oversold or overpriced, you can use a scalping opportunity. Let me provide you with an example of trade execution. You can spot a bullish candlestick pattern in the 1-minute chart of a tech stock. You can buy in and slide a stop-loss to breakeven, taking profit as per the current ATR value. If the stock moves against you, you just exit and look into another company.

High Win Rates

Within the world of 1-minute scalping, a high win rate is essential due to the lesser margins of profit made at each trade. In this regard, here are the tips on how to increase your chances of winning as much as possible:

-

Understanding Win Rates. In the context of trading, a win rate of the high percentage of trades made that ended up in profit. For scalping, when all trades are made to earn a slight profit, a high win rate is essential for the overall performance. Usually, the scalpers whose goal is to break even and live thanks to trading try to achieve at least 60% of the win rate.

-

Quantify with Data. To improve the rate of success, every made trade should be tracked. It is essential is to make a trading journal with information about entry and exit of every trade and the result of it. The data will help in recognizing the trends.

-

Data Example. For example, in the course of last month, it was made 100 different scalping trades. 65 of those trades ended in profit. This means that the win rate was calculated as 65%.

-

Trade Management. It is still possible to lose with a high rate of winning. The average size of a winning trade should be always bigger than the average size of a losing trade. Usually, the 1:2 risk-reward ratio is acceptable.

-

Strategic Entry and Exit. To reduce risks and increase the possibility of a winning trade, most traders use regulative indicators. They can be RSI, MACD, or Bollinger Bands.

-

Trade Scenario. In this scenario, the scalper is trying to sell one lot of EUR/USD. The stochastic oscillator on the graph shows it is overbought. The position is open at 2120, and the stop-loss is placed shortly above the recent high at 2140. The take-profit spot is the 2110 at the shown recent suspicious demand. Such ratio should be 1:2.

Nonetheless, the biggest challenge for a scalper is to retain discipline at all times. Even if the plan is perfect, it is vital to follow it despite the several lost trades in a row. Impulsiveness leads to lower win rates.

Choosing a Broker with Low Spreads

Spreading is an essential factor for scalpers when choosing their broker as it may significantly affect your profitability. Here is how to choose the broker that would offer spreads that will not eat your profit margins.

Spread Impact: In one-minute scalping, with profit being very small, even a minimal difference between a bid and ask price may decide whether you win or lose. You should find a broker with low and consistent spreads.

Spreads in Numbers: Look for brokers offering spreads that are tight, ideally between one and several pips for major currency pairs. For the EUR/USD pair, the low spread would be between 0.5 and 1.0 pips.

Average Spreads: Make sure that not only minimum spreads are low but also the average spreads during the peak time of the day. Otherwise, you should expect that you may encounter something different when trying to trade.

Example with Data: If you chose to scalp the GBP/USD pair and your broker’s average spread is 1.2 pips, and the other broker offers you 1.5 pips, then over 100 trades, the difference would be 30 pips, which is the difference that would affect your bottom line.

Commissions and Fees: Consider whether to choose a broker with zeero-commission fees and only spreads charged, which is always the best decision for a scalper.

Broker Reliability: A broker you choose should be reliable, meaning having a good reputation and a record of successful withdrawals . Moreover, execution times should be fast to execute dozens of trades within a minute. Order execution during peak times when the market is very volatile.

Customer Support: The more responsive customer support your broker offers, the better. Therefore, order execution during peak times when the market is very volatile. . Choose between two brokers: both offer low spreads. However, one broker’s execution times are slow, while the other one has slightly higher spreads but is well-known for its fast execution.