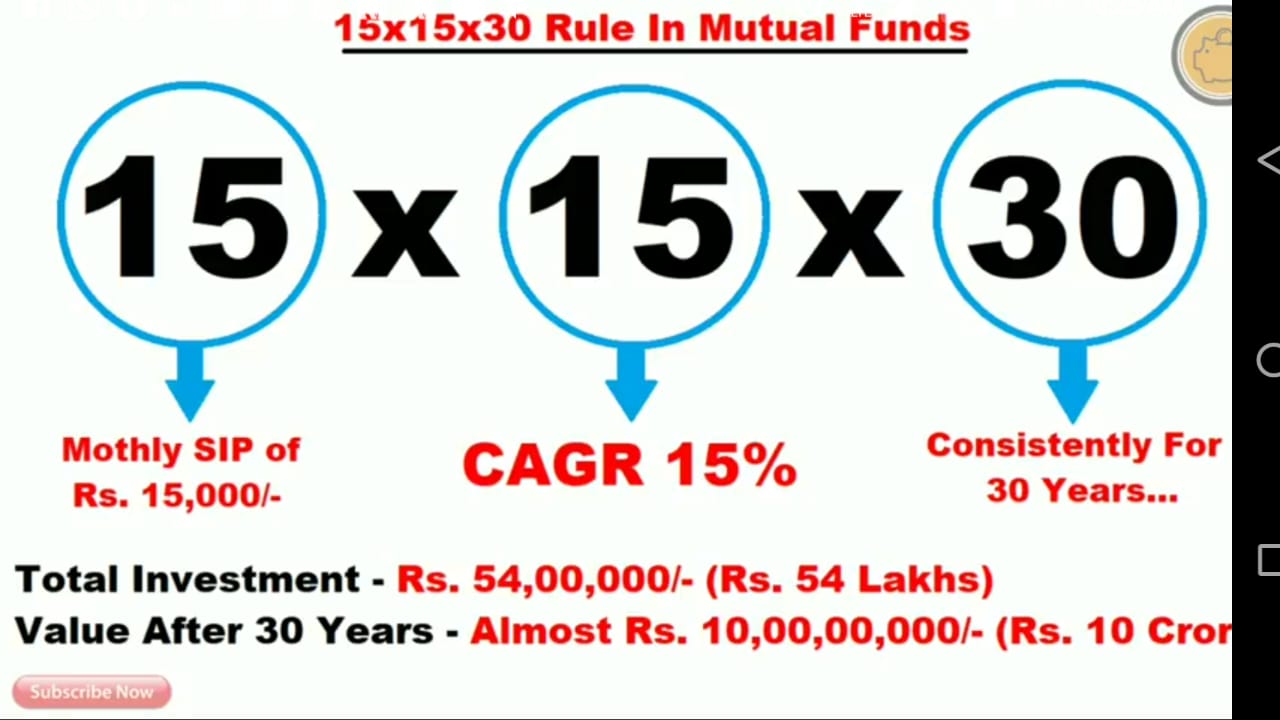

Understanding 15-15-15

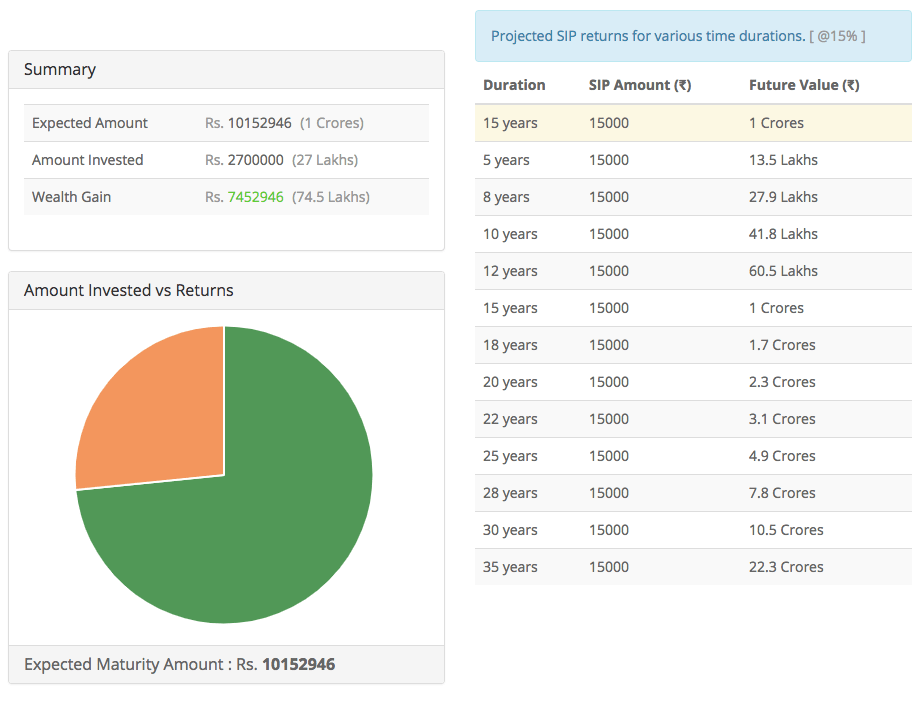

Applying a 15-15-15 investment strategy implies depositing $15 thousand in an account for 15 years and expecting 15% per year. The accumulated funds can cover a significant part of the investment portfolio or act as its basis. The strategy is quite simple and beneficial, as it benefits from two essential features – compound interest and long-term period. With compound interest, one can generate revenue on revenue, which is especially effective for long-term investments.

The formula of 15-15-15 is using the 72 rule for calculating the number of periods until the investment doubles . In our case, the rate is 15% per year; thus, we can calculate that $15,000 will turn into $30,000 in 4.8 years. In other words, in five years, it will grow twofold if the number of conditions is maintained. There are several benefits that guarantee the effectiveness of the strategy. Even if the rate is variable, one cannot expect the efficiency of other arrangements with lower interest rates necessarily. Second, the strategy does not require high amounts of deposits, which is particularly useful for newcomers. Although the required investment depends on personal goals, it is a relatively low sum for the potentially obtained profit. To succeed with 15-15-15, the investor should be patient and consistent, remembering that the higher the initial deposit, the more profitable will be the result in the end.

Tips for Investors

Calculate the result: To evaluate the potential of the 15-15-15 strategy for one’s investment goals, the investor should calculate the amounts and opportunities that can be developed by the period’s end. Those who can afford more than $15 thousand for the initial deposit should not hesitate – the difference between the various sums will be quickly paid off and bring additional revenue at the end of the period. Thus, if the estimated reward is sufficient, the investor should proceed with implementing the chosen strategy. Select the investment option: Decide whether to invest in stocks, bonds, or other assets and find a suitable offer, avoiding undue risks.

Diversification is your best defense against volatility. Don’t put all your eggs in one basket; rather than that, spread your investments across various sectors and even asset classes. It may also be helpful to contact a financial advisor who will help you fine-tune your portfolio to your level of risk tolerance, and financial goals. Staying Disciplined

The 15-15-15 strategy demands discipline. It’s not about investment that makes money, or buying the stocks that are poised to grow, nor is it trying to time the market correctly. Set up automatic contributions to your investment account if you can, and try to avoid the temptation to buy anything with the funds. Fluctuations are a natural part of the investment process, and this strategy relies on the long game.

Market Volatility Handling

Market downtime is always nerve-wracking to be involved in as an investor. However, the markets are cyclical, and you can use the downturns as opportunities to buy good-quality stocks at a lower price, which should boost the long-term performance of your portfolio. You should also disregard short-term roads and focus on the latest developments. After all, it’s the amount of time spent in the market, rather than the timing, that matters. Maximizing Your Returns

Truly invest as much of the money you gain back into your stocks and bonds, increasing the effect of compound interest, which will allow your money to multiply more quickly. Also try to avoid too-high fees that lower the returns on your investment. Finally, you are strongly encouraged to double down on low-cost index funds or other exchange-traded funds. Basics of the 15-15-15 Rule

In simple terms, it’s investing $15000 at a 15% return rate for 15 years in a row. The beauty of this strategy lies in its simplicity and the power of compound interest over a longer period than 10 years. Let’s examine the elements you should be aware of, and how to make the most out of this investment philosophy.

The Magic of Compound Interest

The 15-15-15 rule is entirely based on the power of compound interest. When your investment grows and earns you interest, that interest also keeps earning you another interest in the subsequent periods . If you invest $15,000 at 15% interest annually and over 15 years, that initial investment will not only grow linearly; it will grow much more due to the compound effect of interest-on-the-interest value.

Picking the Right Investment

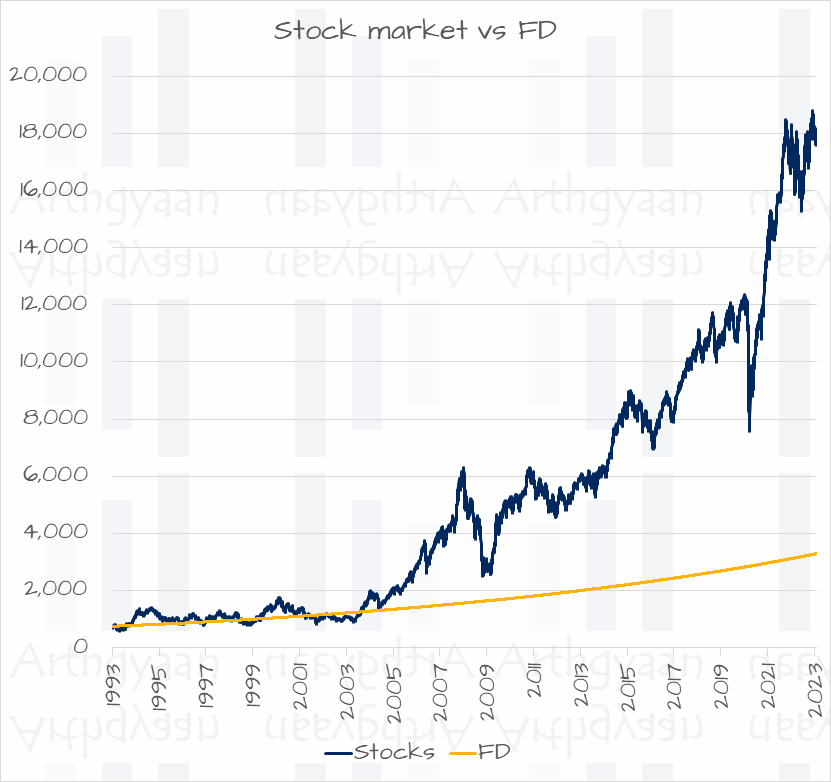

However, to achieve a 15% interest rate for 15 consecutive years may be relatively challenging . While you cannot predict how the stocks or the mutual funds purchased will perform in the future, the best option is to think about which ones have been growing at that rate in the past and either investing in them or tracking them closely to see if they can meet your goal. It may also require the services of a professional financial advisor or to do much research to get some advice to make sure that your goal is realistic and achievable without too much risk to take.

Time

Another primary reason for the 15-15-15 rule is that you keep your investment for a total of 15 years before you withdraw your account. Time is necessary for the compound interest functionality effect to happen. The longer the money is left to compound, the higher your return will be. You need to make sure you stay calm even when the market is low and resist the temptation to withdraw your account before the time is up. Finally, even with the diversification towards the end, you will always be at risk of losing everything if you never keep an eye regularly on your investment to see if adjustments are necessary.

Reinvesting Returns for Maximum Growth

To maximize the benefits of the 15-15-15 rule, reinvest any dividends or returns you receive. Reinvesting is an incredible way to gain more profit, as it will boost the amount of principal and, consequently, the overall growth of investment. Keep your eyes open and find ways to reinvest the returns.

The 15-15-15 rule is more than just a number or some advice. Ideally, the 15-15-15 rule is a matter of discipline, including but not limited to patience, research, and following the rubric to take on risk wisely. As such, investors may convert relatively small amounts of money into a substantial egg nest. This largely pertains to the power of the 15-15-15 rule over time and rhythmic compounding.

The Mechanics of Compounding in the 15-15-15 Rule

One of the strongest forces in genteel personal finance and investment is compounding interest due to the reinvestment of earnings, which make their own earnings in turn. Compounding does the following with the 15-15-15 rule.

- Allows investment capital grow exponentially, because interest is earned on top of not just the initial investment but also the previously accruing interest.

For a 15-15-15 rule, if you invest $15,000 with a 15% interest rate per year, your money will not grow by $15,000 after each year of investing – won’t the new investment amount be interest. In fact, $15,000 will grow from accretion year to year, and interest will be credited to the latest amount. Due to the exponential effect of the 15-15-15 rule, your investment will grow many times faster, as in the hypothetical reflected by numbers over the next 15 years.

Calculating Compound Interest

To feel the impact strength of compound interest correctly, it is important to feel the formula: A = P ( 1 + r/n ) nt , where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial amount of money).

- r is the annual interest rate (decimal).

- n is the number of times that interest is compounded per year.

- t is the time the money is invested for in years.

Thus, for the 15-15-15 rule and annual compounding: For example, one would calculate the final amount available at the end of 15 years by utilizing the values in the explanation above. This shows that the original $15,000 investment grows as time goes on, partly thanks to it being compounded.

The Role of Annual Return

Making a 15% return is ambitious for most investors and requires that investors make the right choices and investments. The types of investments most likely to offer this kind of return include high-growth stocks, as well as mutual funds and ETFs. One of the most important steps that investors should take when trying to reach this goal is making sure they do their research and may even need to consult a financial advisor to make the correct choices.

Additional Contributions and Growth

While the most basic version of the 15-15-15 rule stipulates the individual investing the entire amount at once, the return could also be seen with additional regular contributions. Even by making small monthly or yearly contributions, the final amount would be very likely to grow significantly. Thus, the invested amount does not have to be invested at once and may also evolve over time.

Constant Monitoring and Adjustment of the Strategy

If an individual has chosen to adopt the 15-15-15 rule with the characteristics and goals above, as it should be a relatively long term investment. Therefore, the individual should be able to see if the portfolio is performing as expected and to adjust their investment to fit their goals which includes the target rate of return. Thus, the investor should not be afraid to rebalance their portfolio or to reinvest dividends with that goal in mind. It is also important to be aware of other factors and changes on the market.

The main advantages of the 15-15-15 rule are as follows:

- Leverages the power of compound interest. The rule capitalizes on compound interest, which means generating earnings on an asset’s reinvested earnings. The bigger the timeframe, the more significant growth your initial investment will experience. It features best over long periods, and the 15-year timeline is the ideal playground for your investment to prosper.

- Encourages long-term investment. The 15-15-15 rule results in the most substantial returns primarily due to its length over time. It also encourages investors and traders to focus on the more distant future and disregard short-term market fads and correlation. A longer-term perspective results in more significant and more stable growth of assets and decreases the temptation to make rash choices whenever the market temporarily grows or falls.

- Demands discipline. Adhering to the investment strategy requires a level of fiscal accountability from investors and manages to spread into other areas of financial life. Consistently saving and investing with the 15-year timeline in mind cultivates a habit of timely savings and investment, empowering adherents with the essential fiscal skills needed to build wealth.

- Offers high returns. The goal of generating a 15% annual return is, indeed, an ambitious task, and one with a fair amount of risks. The more significant the investment and growth, the more potential gains investors will sustain over time. It is still possible to achieve such growth while simultaneously managing the associated risks and preventing the loss of all assets by carefully selecting and managing the stocks.

- Promotes financial planning and education. Lastly, the involvement in the 15-15-15 rule incites investors to keep themselves informed about the market, the financial instruments at play, and strategize investment growth.

How Flexible is the Strategy? The 15-15-15 rule outlines a specific goal, but there is flexibility in how to travel there. Investors may pick from many different assets to reach a 15% annual return. This means that the investor can tailor the strategy to adjust to their risk tolerance, market conditions, investment preferences, and personal financial plans. This ensures that the strategy can be adjusted accordingly based on the sense judgment of the investor. How Can the 15-15-15 Rule Be Adapted? To be able to adapt the rule, I will consider my current financial status, my financial goals, the risk that I am willing to take, and the timeline that I have to make the investment. Adjusting the investment amount. Based on my personal circumstances, I can either invest a lesser amount initially then adjust as my income increases. On the other hand, if I currently have a significant amount, I can choose to invest a higher amount initially. Adjusting the rate of return. While it is more conservative, I may be more comfortable with this rate of return than the suggested 15 percent. Some may consider gradually increasing their return expectation each year by using the average formula for computing returns . This can provide the investor with a lower risk since it is moderate.

Extra time or shorter period

The 15-year investment period is based on the concept of the power of compounding. Nevertheless, you may have a shorter period due to a planned expense or a retirement plan with a longer period. If choosing to invest for a longer period, you continue to compound your interest. However, if you want to shorten the period, you will have to change another part of the strategy with $15000, such as increasing the monthly amount or selecting a riskier strategy at a return over 15%.

Choosing the right investment

Another vital part of the strategy is the investment vehicle that guarantees 15% return. There are various options for such a return, especially with the risk consideration. The strategy allows you to choose the right mix of investments that mirrors your target risk level or aligns with your expectations in the return that may include a diversified set of stocks, bonds, mutual funds, or ETFs. It gives you a range of options to choose the most appropriate. Regular contributions

In reality, you may NOT have $15,000 to invest at once because you may have significant expenses. However, you may choose another approach of regular contributions. It will serve you better with the Dollar-Cost Averaging and take advantage of market volatility. Consultation with a financial advisor

Implementing the change in the original 15-15-15 rule may require more knowledge and information than you have about investment. Investing and wealth management are individual, and you need the right advice and expertise. Working with a financial advisor is the best way to align the modified strategy with your future financial needs.