5-minute charts are better analyzed with the Exponential Moving Average as it is more responsive and adaptable.

The moving average gives more weight to the most recent price change, making it more sensitive to recent market trends compared to the simple moving average.

It enables traders to identify and capitalize on short-term trends as traders need to on 5-minute trading. EMA allows reducing lag, depending on the trader chosen value. An adaptive moving average gives timely signals for potential entry and exit points.

With the EMA, traders can utilize a wide selection of methods including other technical tools for short-term trading analysis.

Sensitivity

The Exponential Moving Average is well-known for being particularly sensitive to the recent price data. This feature makes EMA particularly suitable for the fast-moving 5-minute trading charts. In contrast to Simple Moving Average , which assigns equal weight to all of the data points in its period and is thus slower in responding to changes, the EMA additionally increases the weight of the most current prices. This way, traders that use this indicator can swiftly respond to the changes taking place on the market. This is particularly relevant to the short-term charts, as within the short times the volatility can change without warning.

Illustrating the Sensitivity of EMA

To better understand the way the EMA works, one can consider the hypothetical situation. A certain financial instrument increases notably in price. A 5-period EMA or 10-period EMA is likely to adapt to this change much more swiftly than a SMA with a similar period, which would show a slight increase in the average. It happens because in case of an EMA, the previous EMA value and a new element, in this case, the current close price, make up a much bigger portion of the average. In general, the EMA can be calculated the following way:

New EMA = EMA of the Previous Day + (Close * smoothing factor )

The smoothing factor can be calculated as:

smoothing factor =2 /(N+1), where N is the period of the given EMA.

In a similar vein, traders that used the indicator during the 2015 Black Swan event involving the Swiss Franc would have noted that the value of EUR/CH increased overnight, although a 1-day SMA would have taken far longer to change its average, a five-minute one would have likely altered its value to reflect the shift on the market. This might have allowed the traders to exit or even reverse their positions.

Smoothness

A characteristic that makes the Exponential Moving Average is smoothness. It is this quality that enables traders to see the underlying trend under the noise that the market produces every day. This quality is particularly useful on the 5-minute charts that are employed in this analysis. Here, the movement of prices is quite volatile and replete with short-term fluctuations that make it challenging to understand where the market is going.

What Is Smoothness? In the context of the Exponential Moving Average , smoothness refers to the quality of the indicator that allows to reduce the influence of random price movements and focus on the general trend. The formula for calculating the EMA makes older data points matter less, so the average value is more reactive to recent price movements without being thrown out of balance by insignificant fluctuations .

Do We Need It? From the formal perspective, smoothness of an EMA can be defined as the pace at which the moving average reacts to a new data point. A 5-period EMA will jump around much more than a 50-period indicator. The speed at which the moving average moves depends on the value of the smoothing factor – the higher it is, the stronger the emphasis on the most recent prices . Accordingly, the EMA helps us have a smoother representation of price movements without too much lag that is inherent to the Simple Moving Average SMA on 5-minute intervals.

History of EMA as a Smooth Tool: As the graphical analysis demonstrates, the EMA has been quite helpful in ensuring a smooth trend line. For example, during the height of the crisis in 2008, the EMA demonstrated a smoother line in contrast to the SMA, which enabled traders to keep track of the downtrend in a large number of trading instruments.

Stable Trade Experience: The smoothness of the EMA enables more stable and predictable trade experiences because it eliminates, to a degree, the noisiness produced by vast amounts of data points. Accordingly, it can be expected to demonstrate a smoother trend line on 5-minute charts, which guarantees more precise trade entries because they will not be thrown off by sudden, more short-lived jumps/drops in price.

Tools Used in Tandem with EMA to Ensure Smoothness: The EMA can also be used in combination with other technical tools, such as Bollinger Bands or the Awesome Oscillator . Both of these indicators can provide further assurance that the general trend is strong enough and can keep verifying that the signals sent out by the EMA are correct.

Trend Following

The Exponential Moving Average is a dynamic tool that many traders use to follow and take advantage of market trends in the rapid context of 5-minute charts. The EMA is one of the top indicators due to its capacity to react rapidly to price shifts. In other words, the EMA is effective in tracking trends because it identifies when prices are in an uptrend by moving up and when they are in a downtrend by moving down. Overall, the ability to recognize trends visually allows to consider the EMA as a trend-following tool.

Quantitative analysis of EMA trend following can be conducted on the EMA percentage rate of change over n periods. An upward moving EMA percentage rate consistently identifies a strong uptrend, and a downward moving rate demonstrates a downtrend. Overall, failure may be associated with the cross-rate moving upward while the 10-EMA is above the price action, which confirms that the current trend is bullish. The most widespread usage of the EMA to follow trends in the past was following the trends of major markets. For instance, in 2018 the EMA on a 5-minute chart with a 50-EMA in cryptocurrency trends can be used to identify the rapid uptrend of the crypto market when Bitcoin and other cryptocurrencies soared in value after their price decline in early 2018 .

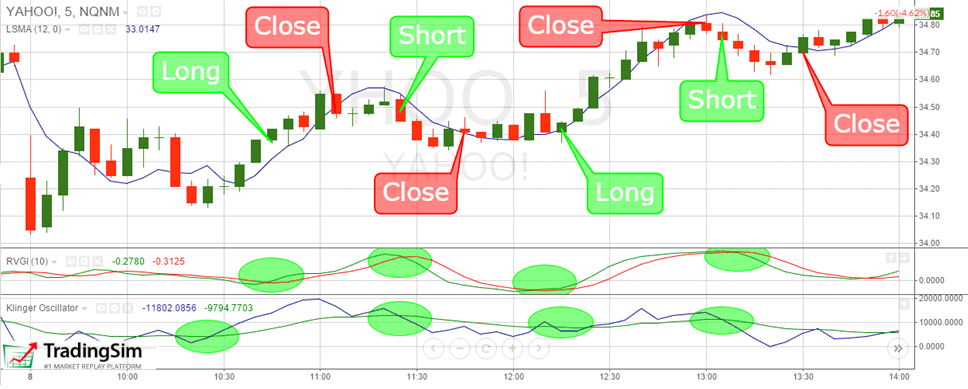

There are several significant reasons why the EMA is the best indicator for following trends. In the first place, the EMA adapts to price changes rapidly, thereby displaying the latest trends, while other types of averages move much more slowly. Secondly, the EMA generates clear signals that represent perfect entries and exits in the trade context. Specifically, the motion of a shorter EMA above the longest EMA earns a signal and value; this is an entry. Trading with the EMA provides another example when the shorter EMA crosses the longer EMA from above; this is the exit. Additionally, the EMA is simple and allows identifying the trends without any calculations. One may be confident in dealing with the EMA when following trends or trading based on trends because other traders do this by using the EMA in selection in many areas in which traders regularly interact. For instance, the most powerful trend following tool in conjunction with 5- and 30-Minute Crossovers is the EMA . Theoretically, the best complement for the trend-following tool under analysis would be the Moving Average Convergence Divergence , as it measures the distance between two moving averages.

Dynamic Adaptability

The Exponential Moving Average use its dynamic adaptability feature for being one of the most responsive modes to the real-time goes in the currency market, especially for quicksilver 5-minute trading chart.

EMA’s Real-Time Responsiveness:

To begin with, the EMA availability to give real-time responses is due to its calculation method. The latter one implies that moving average will be updated significantly more with each new price bar, conforming to the conditions of market trend at that moment. Therefore, in opposite, for SMA all past prices are equally treated.

Now let consider the dynamic adaptability aspect:

When market price moves above the current EMA, new EMA value will be higher to reflect this increase . This change size will depend on a coefficient, which will be bigger for more short EMA periods. In this way, we guarantee that EMA recognize the recent price change.

Let’s remember historical context of EMA dynamic adaptability:

While the time audi of the Swiss Frank case in 2015 has shown that EMA would also react to new price conditions immediately providing the traders with the vision of the floor 31.6 R2.

Summary of dynamic adaptability key features:

-

Ability to recognize the current trend direction immediately- so traders always are updated about the events happening in the markets.

-

More rapid adjustment to new data, which allows to decrease the time lag of moving averages. The latter one is crucial for such strategies, waiting for confirmation with the moving average when it touches or crosses with it in chase of a stock or currency pair’s place.

-

Workable flexibility across the board with some tools being suitable for EMA and SMA, others only for the former one.

-

Market acceptance among traders of EMA as a key tool due to its immediate contribution to real-time market conditions.

As a result, EMA’s dynamic adaptability is one of the powerful tool usages because it gives the best real-time reflection of market conditions and can be easily utilized in trading strategies for tackling the volatile nature of the market. Also, EMA can be extremely helpful with other tools that increase its dynamic adaptability, such as oscillators or momentum indicators. Thus, Stochastic Oscillator combinated with , can inform a trader about overbought/oversold market situations.

Trading Decision Aids

The Exponential Moving Average is a strategic tool to support trading decisions. It is especially beneficial to use in the “high-speed” context of 5-minute charts where the ability to make decisions promptly with limited information is vital. The primary mechanism of how the EMA serves such a purpose is that it serves first and foremost a filter for taking a trade one way or another. This means that it allows us to draw a clear trend line for the plot, which can be used to decide whether to initiate a new position in the direction of the trend, or close the existing one. From a quantitative perspective, one may say that the EMA supports trading decisions when the crossovers happen, i.e. when a short period EMA crosses over a long-period one. Correspondingly, a bullish crossover is considered when, for example, a fast 10-period EMA crosses the body or slow 50-period EMA, which is also known as an entry point. A bearish crossover supports a sell.

The EMA had proven to be a useful tool historically during some of the market events. For instance, during the first big gold rush in 2011, those who intended to use a 5-period EMA over a 5-minute chart as a decision aid could spot crucial entry points during the rapid hike and benefit from the gold accumulation throughout the process. These are the primary characteristics of the EMA as a decision aid:

-

Clarity in trend direction. As mentioned, the EMA serves the purpose of establishing a clear trend, which is a significant mechanism in the strategic decision-making process for traders.

-

Timing of entries and exits. By observing the EMA and its interaction with the pricing action, traders may more reasonably time their entries and exits, which is important to join trends at an earlier point and leave before they retract.

-

Risk management. The EMA is also a valuable tool for setting the level of the stop loss dynamically. Traders may set a stop loss shortly on the opposite side of the EMA to discontinue the trade if the trend does develop as expected.

-

ConfIDence in EMA as a decision aid. TrDers may also fairly conFIDently use the EMA as a cutoff to provide effective decision support for the certainty of its performance in various market conditions.

Reduced Lag

Key takeaways:

-

The Exponential Moving Average is known for its reduced lag, a vital characteristic for five-minute chart traders who rely on every second of price action for trading decisions.

-

The reduced lag in EMA can be explained by its design. The formula of EMA gives higher weight to the most recent prices, reducing the impact of past prices on the overall average. Meanwhile, a Simple Moving Average gives the same weight to every price within its period, thus lags behind any new information.

-

One can quantify how fast EMA reduces the lag compared to SMA by tracking the time lapsed since the price action change and the indicator’s response to this change. For instance, it would be easy to recognize a spike or dip in price through EMA as it would change the direction, while SMA would still be rising after a dip and declining after a spike.

Historical example of EMA lag reduction:

In May 2010, the so-called Flash Crash happened, which was a swift decline of major US stock indices. Should a trader include the five-minute exponential moving average in their list of indicators, he would see that in the wake of the Flash Crash, EMA would switch from an uptrend to a downtrend instantly. Thus, EMA lag reduction is beneficial for a trader who wants to react quickly to fast market changes.

What does reduced EMA lag imply:

-

Prompt updates regarding the overall market trend.

-

The change in trend on the line immediately alerts the market about potential active trading opportunities.

-

Trades may be executed with less lag, allowing straightforward decisions based on the price action.

-

The trader may have confidence in EMA’s lag reduction benefits since its signals are comparatively closer to the current market.

One may expand the use of EMA with other indicators to further minimize the lag. For instance, inclusion of volume indicators or momentum oscillators may provide an additional sense of confidence when applying EMAs for trade entries or exits.

Compatibility with Trading Strategies

The Exponential Moving Average is not just a self-sufficient tool but also one of the most compatible indicators with a variety of trading strategies. Using the EMA is especially beneficial for trading on 5-minute charts, which tend to be more dynamic compared to longer time frames . The indicator can be used due to its sensitivity to recent price changes, paired with reduced impact of short-term fluctuations, which allows it to define the underlying trend effectively. At the same time, this is the reason why the EMA is the core feature of the majority of trading strategies.

Adapting EMA to Different Strategies: The advantages of the EMA in defining trends and the balance of focus on recent and overall dynamics are the main reasons why the indicator could be adapted to a variety of strategies. Compatible strategies can easily be changed depending on the length of the period. Typically, shorter form EMAs with 5 or 10 period length are used for more aggressive, short-term trading. Meanwhile, larger period EMA can be applied in longer-term, days, or weeks long trades with periods ranging from 50 to 200.

How to Measure EMA Compatibility: Compatibility with different strategies can be measured by weighing the effectiveness of the EMA in combination with other indicators or strategies. For example, EMA compatibility with the RSI to determine oversold or bought conditions or Bollinger Bands to define price volatility . The way the EMA was applied in previously successful historical strategies can provide a measure of compatibility. For example, an analysis of the 2008 Financial Crisis shows that EMA could be successfully applied in combination with RSI on a range of currency pairs. The efficient identification of trends could be even more beneficial when used to define main resistance and support points.

Core Features of Compatibility:

- Compatibility with any timeframe: Any trader might use EMA whether the strategy is based on a 5-minute chart or a Weekly chart, for instance. This accounts to different trading approaches. Synergy with different tools: As it can be seen in multiple examples of compatible strategies, the EMA typically goes well when used together with other indicators and forms of analysis. Tailor-Made approach to analysis: Application of different period length EMA in different strategies. It also shows, that it is compatible with both simple and complex forms of trading strategies. Level of Confidence: Traders can be entirely confident in using this tool as it was proven effective in many situations and yet can be adapted to any.

How to use the EMA to Boost Strategy: There are a few ways the EMA can be used to improve the effectiveness of a strategy. For example, traders might experiment with different period length combinations, using a fast EMA to define when to enter a position and slow EMA to settle when to exit. Moreover, the EMA can be used to establish auxiliary, dynamic Stop-Loss, and Take-Profit levels.