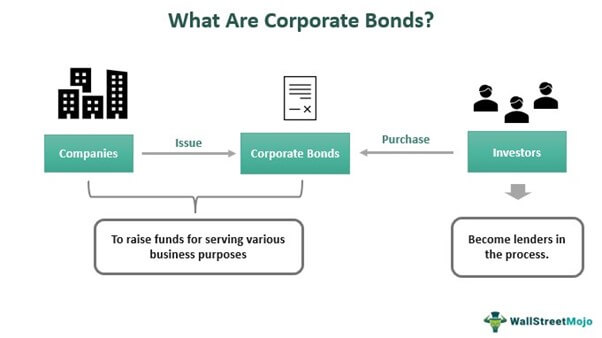

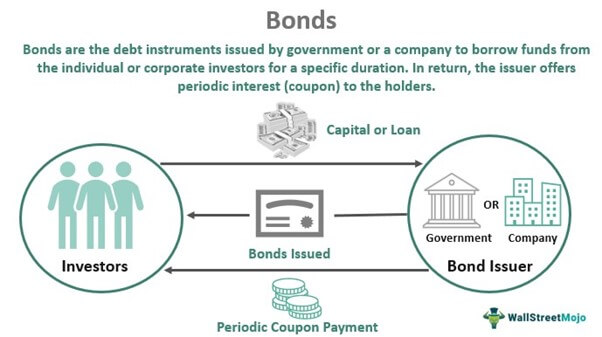

Generating Capital for Operations and Growth

Often, companies resort to the bond market as a way of raising funds that would be necessary for the achievement of its goals, whether they are related to its everyday operations or long-term growth. The issuance of bonds allows companies to acquire significant amounts of capital without the need to dilute ownership shares for its existing stakeholders. For example, in 2020, Apple Inc. issued $14 billion worth of bonds, which were to be used for development, product manufacturing, and branch expansion. When completing such operations while the interest rates are low, companies can benefit since debt funding is more advantageous than equity financing regarding its long-term costs. When funding new project or expansion through the issuance of bonds, a company can count on the low rate of interest and high volatility of equity markets, which can make equity ownership expensive in the long term.

Diversifying Sources of Funding

Issuing bonds, in addition to the possibility of raising significant amounts of capital without equity dilution, allows for the diversification of funding sources. As it is expensive for a company to finance its activities only through bank loans or equity, the introduction of bonds into corporate funding leads to decreased volatility and reliability risks. The necessity of such diversification can be explained when looking at Google’s parent company, Alphabet Inc., which issues bonds almost every year. This allows the company to avoid the high volatility of a single source of funding.

Strategic Financial Management

One of the ways of managing cash flow and capital structure strategically is by issuing bonds. Companies can make the timing, terms, and size of bond issues to optimize their financial position. Amazon issued $10 billion in 2020 on bonds of varying maturities. The company achieved a perfect way of strategic financial management by raising enough money to finance immediate expansion plans while spreading the repayments over several years.

Enhancing Investor Relations

Companies can also decide to issue bonds to attract investors to increase their financial position. The nature of bonds is such that they often attract investors with a different investment profile who are looking for security and fixed-income issues.

Advantages Over Equity Financing

Companies that need to raise financing are always stranded with a decision of whether to issue bonds or to sell more shares. Debt financing has several advantages that often outweigh other methods of raising capital. One of the main advantages is that issuing bonds does not affect the issue of control and ownership of the company. When companies issue bonds, they do not give away shares or ownership. In equity financing, selling more shares means that the ownership of the company is diluted and the owners’ control is reduced. The reduction in control translates to reduced influence over the direction the company should take.

Strategic Capital Structure Management

Companies that are issuing bonds improve capital structure and optimize debt and equity mix. Undoubtedly, capital balance is vital for maintaining correct leverage and decreasing cost of capital. Such measures will significantly increase value through the cost of equity and weighted average cost of capital. A tech firm that issues bonds with the primary goal of expansion and growth can leverage while maintaining the growth of its equity. By doing so, the tech company will be able to adjust the WACC optimally to sustain its long-term plan.

Strategic Financial Management

Strategic financial management is not about managing the daily finances of a company but making financial decisions that shape the future of a company and create value for the shareholders. It combines financial planning, capital structuring, and investment, and these decisions are critical in navigating competitive markets and economic fluctuations. A solitary mistake can lead to substantial losses and reduce value. Every enterprise should have a financial strategy in place to support the company’s long-term objectives.

Optimizing Capital

Analyzing a suitable capital structure is the foundation of strategic financial management. Debt, equity, and internal funds should be mixed appropriately to ensure a low cost of capital while optimizing the value of relevant bonds. A multinational company that plans to expand its operations requires money to make the right decision between issuing more equity or acquiring debt. After that, it will determine the most expensive method and adopt the cheapest way.

Strategic Planning and Forecasting

Lastly, strategic financial management entails the rigorous strategic planning and forecasting. Companies must develop and update their financial forecasts, modeling different situations to prepare for upcoming challenges and opportunities. Each company needs to regularly forecast its future sales growth, including future expenses and cash inflows, ensuring the company’s liquidity in terms of running daily operations and investing in growth. For example, a retail chain is going to open stores nationwide within the next five years. Thus, it will need to forecast capital expenditures for new stores and forecast the need for additional working capital to finance increased inventory.

Lower Interest Rates as Compared to Banks

The primary reason why companies opt for issuing bonds rather than using bank loans only is the opportunity for lower interest rates. This may protect a company from extra cost entailing from the loan and help it to redirect saving made from lower interest payment and additional venture so formed to anywhere the company deems important.

Market-Driven Pricing

Bond interest rates are generally lower than the rates of bank loans because the interest rates of bonds are generally market-driven. The interest rates of bonds reflect the interests and demands of credit investors, and they are established based on how stable the issuing company is and the current market situation. For example, a big company that has been existing as running its operations effectively with a good credit rating might issue bonds to investors at far lower rates than it would get in any bank.

Issuing of Bonds

One way in which companies benefit from issuing bonds at a lower interest rate than the banks offer is strategic financial flexibility. The money saved as a result of issuing at a lower rate can be re-directed to foster growth opportunities. More specifically, a company may re-direct the saved money to finance research and development, investment in the company’s growth, or enhancing the value of shares by way of paying dividends or buying back shares. For example, under this scenario, a tech company might issue bonds at a low interest rate in order to finance their aggressive expansion on foreign markets. Therefore, it is absolutely logical that the interest rate effectiveness of the IRS rule 5062-01 should be strengthened.

Tax incentive

One of the major advantages of the interest expense for corporations is that such expenditures are fully deductible for tax purposes. The ability to deduct interest on debt from corporate income tax greatly increases the popularity of debt financing over equity financing. This way, corporations are encouraged to borrow additional money for the purpose of financing their everyday programs or expansion into new segments in that they have to pay less as a result. For example, a company earns $1 million in a year, and pays $100,000 during the same time period as interest on its bonds from the people in the private sector. In that case, this sum will directly decrease the company’s tax bill, while also helping the respective company to improve its cash flow and profitability.

Comparative Advantage in Financing

The tax incentives surrounding debt financing provide it with comparative advantage over equity financing, particularly in select tax jurisdictions. The use of debt allows companies to maximize their after-tax income by issuing relatively little debt, thus increasing their resources and returning the remaining money to its shareholders, investing in their business or repaying their debt. It is likely that a technology company planning to use aggressive expansion strategies will choose to issue bonds rather than equity in such cases, and will reduce the cost of their debt financing by making interest payments tax-deductible.

Maintaining Company Control and Ownership

One of the most strategic reasons for businesses to issue bonds rather than seek equity financing is that this approach allows businesses to maintain control and ownership. Companies get the money they need for growth and expansion without fear that the founders or current owners will lose decision-making power or a portion of their profits.

Avoiding Dilution of Ownership

The issuance of new equity decreases the share of the company’s ownership that each shareholder has, thus is reducing the current shareholders. Bonds, on the other hand, allow companies to raise money to fund their expansion while maintaining ownership of their companies. Keeping separation from the company they own is particularly important for founders and existing shareholders. For instance, when a housebuilding business owned by his or her family needed to build additional housing, they issued bonds to avoid diluting their ownership.

Preserving Decision-Making Power

A critical aspect of maintaining control is preserving the decision-making power within the company. By opting for debt financing through bonds, companies ensure that strategic decisions remain in the hands of existing owners and management. Equity investors, especially those holding significant stakes, may seek a say in company decisions, and this can both cause conflicts and lead to changes in direction and purely financial strategies. For instance, a startup company in a tech-related field may look for the funding of research and development efforts by issuing bonds, which will prevent possible pressure to stop pursuing innovations that could bring products to the market sooner in favor of those with an immediate financial return.

Flexibility in Financial Planning

Bond financing additionally provides significant flexibility in financial planning, as there is no need to consult or gain the approval of equity investors for major financial decisions. This freedom from control is especially vital for long-term decisions and those requiring the swiftness of execution in response to current market conditions. For example, a manufacturing company may identify a need to replace its outdated equipment with more efficient and cheaper to produce models and look to do so immediately upon receipt of bond funding rather than enter talks with new equity holders.

Strategic Benefits of Fixed Payments

The fixed interest payments of bond financing allow for predictability beneficial for financial strategy. Unlike with equity financing, where the dividends distributed to investors are volatile and contingent on profitability, the amount and date of bond interest payments are predetermined and ensure continued feasibility within the company’s budget. This allows for better management of cash flows and long-term financial planning. For example, a retail chain considering ramping up the number of stores nationwide may benefit from bond financing as the store growth strategy will be more sustainable due to the nature of bond payments.

One exciting way of achieving enhancement of shareholder value without affecting dilution is the use bonds as opposed to equity for financing purposes. This way involves an anticipation of higher earnings per share to the existing shareholders. As the company’s profits grow, they would be spread among similar amounts of shares. This is an interesting approach in the sense that, for example, technology companies may make huge profits thus increasing EPS upon launching a new product or service and the benefits would be enjoyed by the existing shareholders instead of sharing with the newly authorized equity holders. Also, the approach would be beneficial to companies in huge growing industries that are likely to benefit from future bursts in earning.